Last week, we discussed how Economic Cycles and Sector Rotation form the basis of investing at Monetive. In this article we talk about Thematic Investing and how it can work with Sector and Macro signals. Let’s start with a definition courtesy of MSCI:

Thematic investing is characterized as a top-down investment approach that capitalizes on opportunities created by macroeconomic, geopolitical and technological trends. These are not short-term swings – but long term, structural, transformative shifts.

These thematic shifts touch every corner of our lives from the growing digital economy, to smart cities and the food revolution, to efficient energy and disruptive and autonomous technology – and so already impact investment portfolios. It is therefore important that investors better understand their exposure to these trends as they construct portfolios and make decisions around future strategies.

This definition says everything about why Thematics appeal to us. We will start with the megatrends that underlie this idea and then drill down into micro themes that are more identifiable and relatable to the hot ideas that ETF’s have sprouted around.

Here would be a good time to point out the value of Indexs’ and ETF’s as the starting point of all research. In particular, we are big fans of Solactive, an Index engineering company. They create and maintain custom indices for funds and ETF’s and they specialize in Thematics.

Solactive “Megatrends are about inevitable major long-term evolutions in society, economics, or the environment, that affect our lives and possibly also have an impact on politics.” They identify 4 megatrends into which each micro thematic can be classified (Solactive Megatrends)

Within each megatrend you can identify micro themes that we are all so familiar with like Metaverse, Fintech etc. It is at this level most Thematic Indexes & ETF’s are created. At Monetive we have been following some of them and have written about them in December & January.

These themes span across industries and sectors but all of them are enduring long term shifts that they are either pioneering or leading or participating in. Thematic investing is very unlike sector rotation. It tends to be longer duration and not synced with the economic cycle.

We illustrate Monetive’s approach with the example of EV Ecosystem. This spans Consumer Discretionary, Materials, Energy, Transportation, Logistics, Industrials, Semiconductor, Software: Cybersecurity, AI, Cloud, BigData, and more.

If you invest in the ETF, you are investing in a broad swath of sectors. If all these sectors are not running, your ETF’s is going to underperform the market sometimes very significantly.

DRIV

LIT

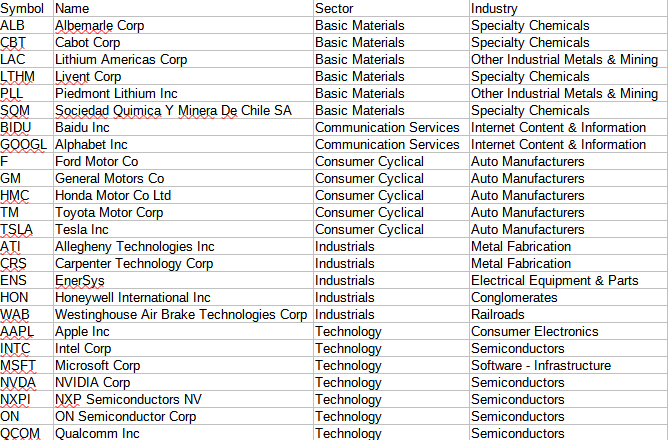

We prefer a hybrid approach where we follow themes but use sector rotation for entry and exits. We search through dozens of Thematic ETF’s and create a comprehensive watchlist of all the companies that the EV ETFs hold. We classify these companies by their respective sectors/ industries. We now go back and use sector rotation framework to get in and out of these sectors but by concentrating on companies that are participating in secular growth themes we are in theory, improving our risk / reward equation. Below is a EV Ecosystem list of top holdings from DRIV, LIT to illustrate.

For every stage of the economic cycle, there are sectors and industries that outperform. Having a watchlist of stocks that are part of long term thematic trends provides additional choices in addition to sector leadership to generate market beating returns. In the current economic cycle, only Specialty Chemicals and select Materials among the industries in the table are running. Why would you want exposure in sectors that are weak and selling off? Lets see this with YTD performance of DRIV & LIT vs ALB and CBT.

By using sector rotation, you are sailing downwind with the market not upwind constantly tacking trying to outsmart the market. The returns speak for themselves.

We look at every Thematic Index & ETF and create a comprehensive watchlist by industry/Sector. When we see rotation into a sector/Industry, we have a list of stocks that are beneficiaries of long term sustaining secular trends and those in our experience tend to offer better Risk/Reward over time. This to us, is the ideal way of stock picking. This approach combines Macros, Geo-Politics Economic Cycle, Sector Strength, Business trends. Market trends and helps us concentrate on a group of stocks are better predisposed to succeed. It is critically important that this is not a static list. We are constantly modifying our watchlist to account for changes including new and emerging themes, competitive landscape, earnings and forward guidance, short term or one time opportunities and more. The watchlist is always sorted by sector/industry strength so we are constantly scanning those stocks on a daily basis for signals. We are also using weakest of the watchlist for short ideas.

There are a lot of wonderful resources on Thematic Investing. Here are some we like:

Thank you for taking the journey with us. In the next post we will tie this together with our watchlist, allocations, sector picks and our approach to hedging and trade management.

Archna and I post updates and responses on Twitter. Please follow us there @MonetiveWealth @Archna2011.