The most important Inflation print in a while

What breaks the bearish sentiment that pervades today?

In a sea of negativity we said that it was time to go selectively long. We were among the tiny minority that called for no surprise from the Fed We were right on the Fed and wrong on the market reaction to the Fed. We still like the watchlist we posted and we are still looking at those to go long soon but when?

Markets move on economic data and the overall macro read is more important than ever, given the number of factors in play: Geo-Politics, Economy, Central Bank tightening worldwide, continued supply chain disruption and a virus that wants to exhaust the greek alphabet. This week it is the release of the April Inflation numbers on Wednesday. It was inflation that started the market sell off and it will be Inflation more than other indicators that will help form a tradeable bottom. Now that does not mean it happens in one print. Lets look at how we perceive this weeks action.

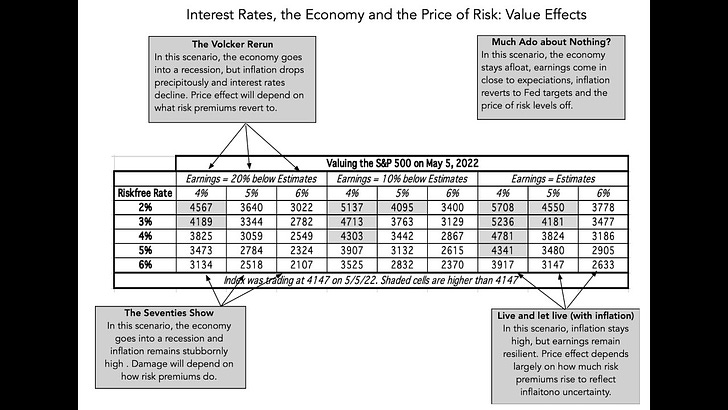

Before we go into our opinion, we will ask you to take time to review this latest video from Aswath Damodaran “In search of a Steady State: Inflation, Interest Rates and Value”. In particular we like the part where he talks about inflation expectations and this is where we pick up our post below. Thanks professor, for another wonderful analysis and explanation!

Here are the probabilities for the Wednesday print:

The consensus among economists is that we get the first neutral/negative print on Wednesday with inflation going down a bit from the highs. This marginal fall or even if it comes in flat is a huge deal in our opinion. It could indicate that upward price pressures are starting to mitigate for a variety of reasons including slowing of demand. While we need much more confirming data to call a top, this we strongly feel will be enough for a kneejerk rally from the oversold levels in the market. Here is how we are looking to trade a CPI driven rally.

If we get a lower inflation print than forecast, we expect a quick strong rally. We like commodity short as the market runs. We think that both Oil and NatGas will pull back and there is a nice profit to be made here. We also like SOXL, semis did better last few days and could lead the tech back up. If we get a CPI print below 8%, we are likely off to the races and any 3X ETF is going go up big. This might be the right setting for SOXL, TQQQ & SPXL. On the short side in this scenario would be utilities and Staples that are selling at ATH.

SOXL: If you take fibs from March highs then 61.8% fib retracement is 27.3. the expected move based options IV for this Friday is $3.85. So from Friday's close of 23.58 we get to 27.43

So SOXL levels to watch to take profits for this week would be in the 27.5 area. If we are going to have a bigger than expected move in SOXL based on the CPI then 28.85 is 78.6% retracement from the March highs.

Since the volatility is high the moves can be big. So stop for SOXL for us would be 21.48 which is the low of 4/27

We at Monetive have been early in our call that small cap Biotech has bottomed. Now we are seeing some options flow come in too. Friday 22K options contracts for Sept 20C on LABU (which is the 3x small cap biotech ETF) came in. This position is making an assumption that by September LABU triples from its current price. So if the market runs on CPI, LABU is another ETF that can be played for the upside. For a day trade, the resistance at 8.9 is where we would be taking our profits.

If the the inflation surprises to the upside: In this scenario, we might get the flush that everyone has been expecting and a massive high volume sell off with VIX having a blow off top. For this scenario we like to go short the VIX in the high 40’s as the selloff loses steam. VIX will come down significantly before marching up again so we believe this is a high percentage trade that we are going to take.

UVIX is 2x VIX ETF. This is a new issue. So if we have VIX over 40 then UVIX could be close to 30. So buying a put spread or puts in UVIX is idea if we see VIX go over 40 and that spike loses steam.

At Monetive, we monitor a lot of data and come up with trades whose risk / reward makes sense in the macro context. While these might not be the highest percentage gainers all the time, they come with a high percentage of success and that translates into reliable returns.

Fed has commenced QT along with other major central banks and these along with other factors will make for a choppy market. You need all the data at your disposal to make investing/trading decisions. You need to do a lot of due diligence in this market to protect your capital. Please do not follow anyone blindly. Always consult a registered investment advisor before you risk your capital.

We will also be posting updates to this and other opinions on twitter. Please follow us @monetivewealth & @archna2011