The longest Bull Market is Dead. Long Live the Bulls

Positioning for current and upcoming economic cycle

This article was posted last week on Barchart.com. It is one of a series I am writing as a contributor at Barchart.

Great civilizations don’t end quietly. The internal decay reaches a point of no return and the last resistance is brutally snubbed out and what is left is chaos, a fear for the future and unending doomsday calls. Negativity pervades and the future looks lost.

Bull Markets are no different. When a bull market ends, logic rarely matters. Sell off is broad and deep and there is nary a place to hide. Seems familiar? We have arrived there.

This article was not to tell you what you already know or hear from every person with a megaphone. So I will begin with a basic idea that is the cornerstone of our portfolio strategy at Monetive.

Economic Cycles and Sector Rotation:

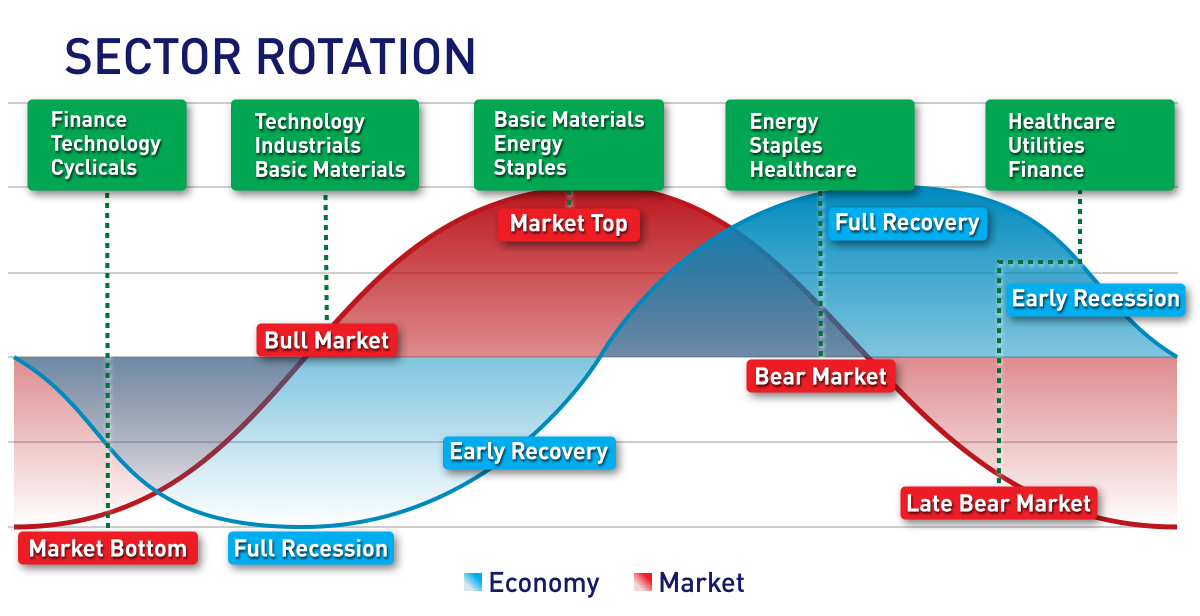

Economy moves in cycles. Looking at the picture below, from left to right, economy moves from the bottom to a growth phase into a bull market and a market top. The peak is followed by a downturn into a bear market and a bottom and the cycle repeats. In each of these phases of economic cycle, certain sectors tend to outperform or offer optimum Risk/Reward. A portfolio rotation that follow sector strength will tend to outperform the market in the long run.

We have stipulated that we are in a bear market. For the last quarter and more, Energy, Staples, Utilities and parts of Healthcare have been the holdouts are one after an other the rest of the sectors gave way. Now in the last ferocious selloff, the Staples have also corrected. The last holdouts seem to be Energy and Utilities and may be a parts of other sectors.

So if we believe that economic cycles will still work into the future, we can use this and other data to position our portfolio for the next phase. Now bear markets can also run for extended periods though typically the policy and politics can’t afford to extend pain and tends to intervene to kick start growth again. Why should now be any different?

Sometimes macros over ride what sector rotation and market cycle would suggest. A good example would be Cyber-Security, Agriculture, Defense, Materials which benefit from pandemics, politics, escalating cold war and escalating trade tensions and cyber threats. Especially in the current oversold state, these sectors with macro tailwinds are more likely to bounce harder and faster.

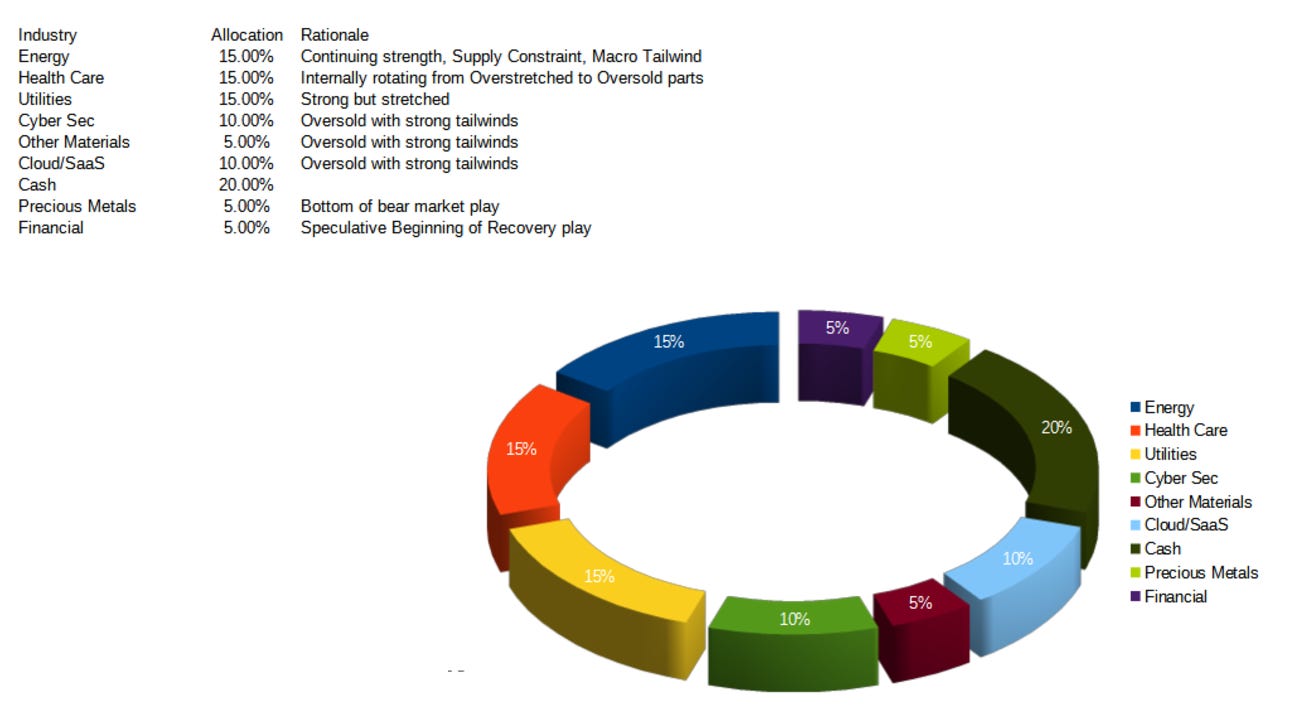

We keep our Portfolio allocation simple. We don’t allocate more than 15% to any one sector.

Sector Rotation based allocation gets 45%. From experience we know that there are a typically 3 sectors in play : One is mature and topping out, one is reaching high velocity and is has the maximum strength and a third one is leading into the next economic cycle, full of promise but the risk reward not yet quiet ideal for full allocation.

Macro Tailwinds gets 30%, may be 2 or three sectors that are in some way showing strength, pricing power, demand and have the head room to run and provide outsize returns.

Lastly we carry 25% in cash. We use 10% for active trading and 15% for rebalancing, since we might not be yet out of one sector but we already see opportunities in another sector

What would this look like in the current context?

Our portfolio is actively managed. We use stocks, ETF’s and Options as appropriate. While Macros and Sector Rotation underlie out allocation strategy, we use technical signals for entry and exit.

We will dedicate the next post to discuss how we fit Thematic Trends into our watchlist & allocations.

Archna and I are posting updates and commentary on Twitter. Please follow us there

@archna2011 & @monetivewealth