Sector Performance and Rotation

Will tech continue to outperform or will there be rotation into other sectors that offer better risk to reward?

We looked at the basics of sector rotation in a past article. As we take this forward, we will look current market situation and how to identify sector rotation and to allocate . To be able to do this consistently, every portfolio needs a decent cash allocation. At Monetive we keep 20-30% in cash for trading and reallocation. Our cash position rarely goes under 10%. We also do not rush into large positions until signals are confirmed and trend is established.

Lets start with this wonderful infographic of sectors and industries

To fully comprehend sector and industry performance, you have to look at industry weightings and sector weightings. You will hear the oft repeated narrative about a handful of stocks responsible for most of the market performance. The top 3 sectors are roughly half the market weight. And the largest companies in each of these sectors are a significant weight of the sector. It stands to reason that their performance will significantly impact the overall market and index performance. That is a function of the construction of the index.

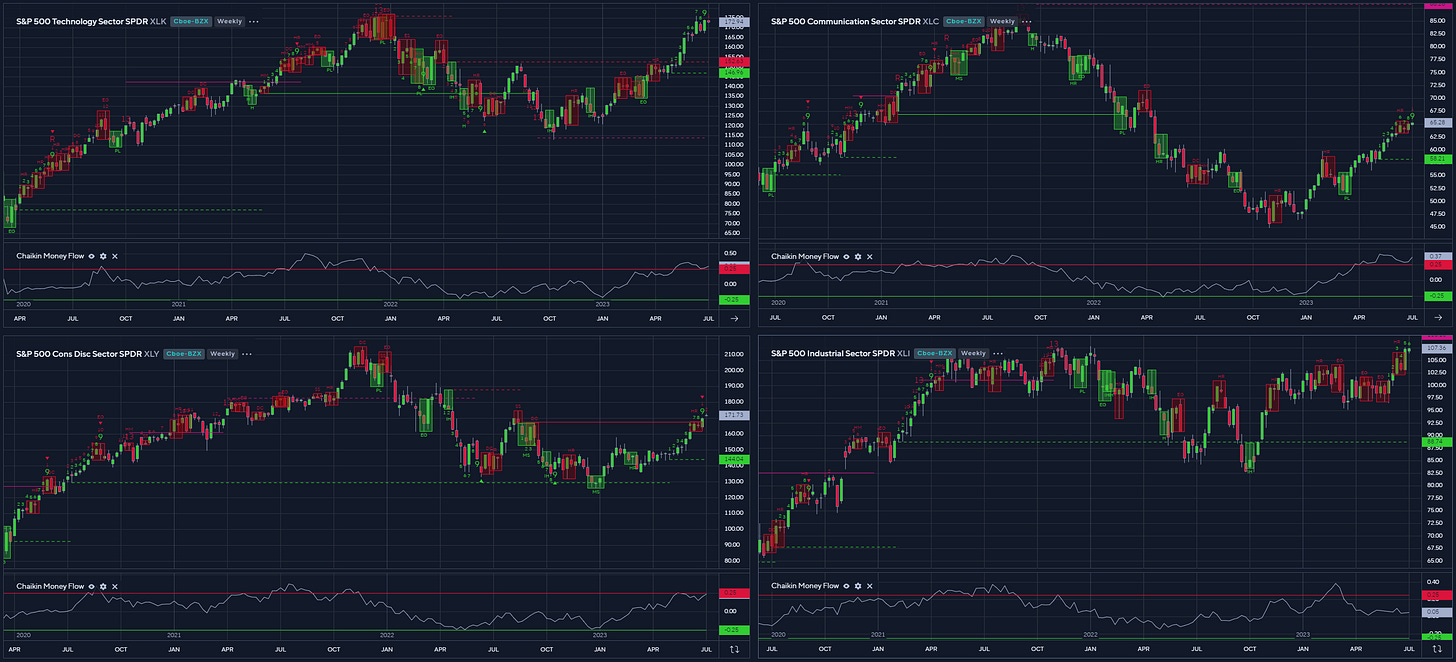

This year has been mostly about strength in the Risk-On sectors namely Technology, Communications & Consumer Discretionary. Industrials have also continued their strong performance since Q32022. These 4 sectors have at led the market out of correction in significant expansion territory. Money Flows into the risk-on sectors has been positive all year and gathering strength while Industrials had neutral inflows but retained performance.

The US economy grew by an annualized 2% on quarter in Q1 2023, well above 1.3% in the second estimate, and forecasts of 1.4%. Consumer spending growth accelerated more than expected to 4.2%, the strongest in nearly two years (vs 3.8% in the second estimate). The consumer price inflation in the United States declined to 4.0 percent in May 2023, the lowest since March 2021 and slightly below market expectations of 4.1 percent, driven by a decline in energy prices. In addition, the core rate, which excludes volatile items such as food and energy, has slowed to 5.3 percent, the lowest since November 2021. supporting the argument for the Federal Reserve to stay on the sideline. The University of Michigan consumer sentiment for the US was revised higher to 64.4 in June of 2023, the highest in four months, from a preliminary of 63.9. Improvements were also seen in both current economic conditions (69 vs 68) and consumer expectations (61.5 vs 61.3). All of these point to lower probability of imminent recession in 2023. This explains the recent exuberance in the market sentiment and the significant outperformance of the Risk-On sectors. Add in the Artificial Intelligence theme, the IRA and Defense Industrial Investments, we can see the reasoning for the sector strength.

So where do we go from here. Let's zoom out to the monthly charts and look at all the sectors

Of the 4 strong sectors, we see Technology (XLK) showing signs of exhaustion with a Demark 13 and resistance at previous highs. The other 3 are still in an uptrend (XLC, XLY, XLI). The rest of sectors are staying on trend without any significant signs of reversal. To us this is important to understand and take advantage of rotation. We are taking profits in the big gains in the risk on sectors and progressively hedging the rest of our position in these areas. It is of course possible that the run continues and we leave profits on the table. That is prudent risk management for us and we are ok to have our shares called away in increments.

Going forward, while we watch the performance at a sector, industry and leader level, we are paying attention to a few macro factors:

CPI and Employment will be released before the earnings season gets under way.

Big Bank Earnings should provide a read in to the health of the economy and the consumer

Fed decision and their outlook will either unleash the market or restrain further gains and lead to some profit taking.

Once we get into the earnings season, it will be all about earnings performance and even more about guidance. In the last few quarters, upbeat guidance has unleashed the best performance. We expect this to continue and we will look for industry trends and individual companies to identify best opportunities for swing and long trades.

Diversified Financials should do well if economic conditions hold up and sentiment improves. Large banks are too big to fail and are the beneficiaries of upheaval in smaller regionals

Aerospace and Defense majors are getting large subsidies to expand defense manufacturing capacity in the light of new geopolitical realities

Transports are outperforming within Industrials and we expect this to continue

Any rotation to safety will see a move into Pharma and Healthcare providers.

Energy sector leaders are still extremely profitable and have decent dividend yield.

In upcoming parts of this article, we will go into each sector post earnings and review setups and also provide a readout on sector strength and positioning.

As always, these articles are not recommendations for investment. You should do your own due diligence and consult an RIA before you invest.

Archna and Monetive are partnering to offer Discord Trade alert service. With Archna’s options trades and Monetive’s sector rotation swing trades, we are attempting to provide more value. You can signup for the service at www.Archnatrades.com. The trade setups shared are real-time trades taken by both. All trades and P/L are shared via a google sheet.

This substack will remain a free service and we will always share our thesis and educational content here.

You can also follow us on twitter @MonetiveWealth and @archna2011