Previewing Expectations for Q4 Earnings

As we close out the Q3 earnings season, we look at the highlights and how Q4 is setting up.

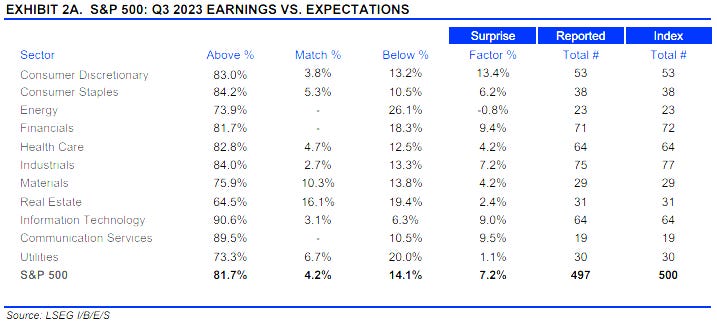

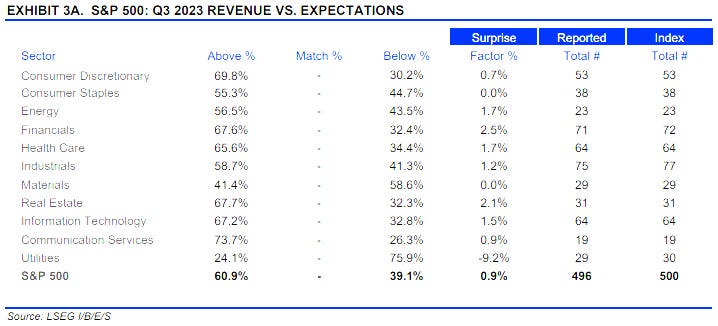

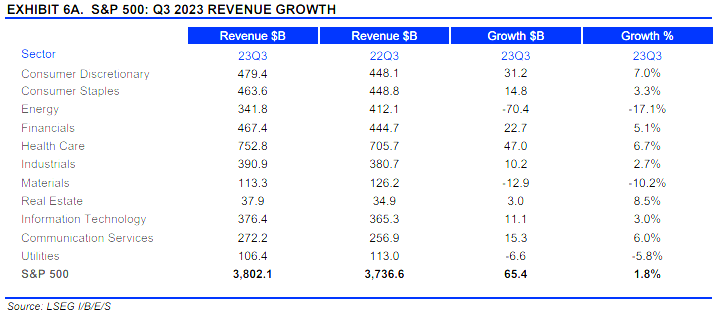

Let's start with a look at the Q3 numbers. By most measures Q3 earnings and revenue came in better than even optimistic expectations. When the earnings season kicked off the expectation was for 1.9% Earnings growth and 1.3% revenue growth. Those numbers were far exceeded with 7.2% and 1.8% respectively. The largest percentage growth came from Communications Services and Consumer Discretionary sectors exactly as we called out in out earlier posts. The laggard was Energy , Materials & Healthcare. It is important to call out that the relative outperformance in Earnings vs Revenue points to costs savings as a major driver. So it is important to dive further into individual companies to see where the growth is temporarily coming from costs cuts vs companies where the growth is sustainable. Also note that the benefits from cost cuts tent to play out over multiple quarters. It is important to pay attention to guidance from companies to see what is driving earnings and how long it will last.

From our earlier posts. we have a few broad themes that are still working well: AI, Growth in AD spending, GLP-1 drugs, Spate of FDA approvals next gen medicine, recovery in med-tech and Defense. We expect these themes to continue into Q4 to varying degrees. We will look to individual company situations to determine our trades.

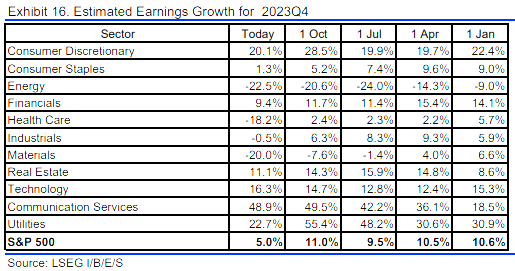

Now let’s turn our attention to Q4. The expectation is for a 5% earnings growth and a 2.7% revenue growth. There are some similarities and differences to Q3. Communications Services and Consumer Discretionary continue to be top growers joined by the Utilities sectors. The laggards are still the same: Energy, Materials and Healthcare. The revenue picture looks even better. Only Energy and Materials are expected to be negative with all the other sectors growing revenue. The growth rates do drop compared to Q3 with outperformance from Technology and Utilities making up the numbers for the index.

The earnings expectations are falling however and will need to be watch carefully as we close out the quarter. This is not uncommon as we have the benefit of company guidance to tighten the analyst estimates. We also have the benefit of readout of the current economic data.

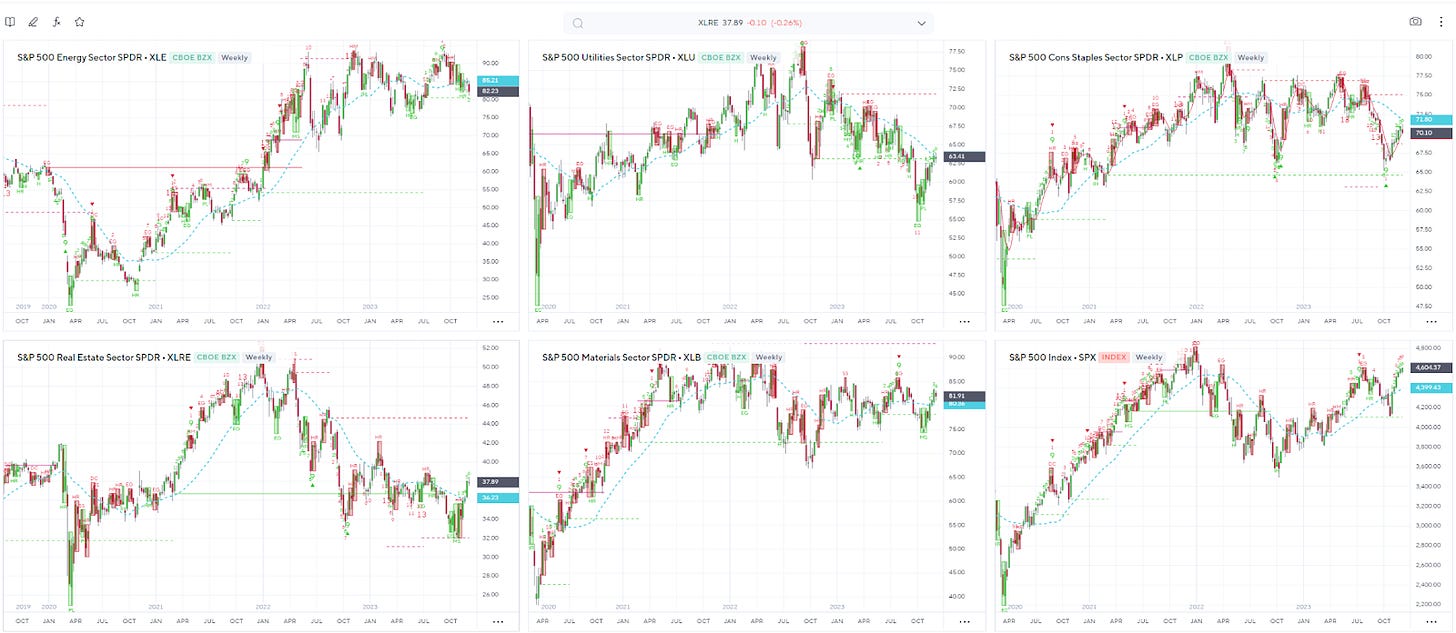

Taking a look at the sector weekly charts, the uptrend is pretty clear in 10 sectors and Energy is the only one showing a downtrend. That is a bullish market with almost everything on the upswing at the sector level. 8 of 11 sectors are above 30 Week Moving Average, 3 are below it. There is no sector hitting the Demark 13 signifying trend exhaustion. All of this is bullish.

So how do we see this play out over the coming weeks into year end and beyond:

Inflation rate is expected to be 3.1%. Anything above that could influence the FOMC commentary and could lead to some profit taking.

A 2 handle on Inflation would be psychological boost for the market and could power it towards ATH after effectively ending the FED action.

Digital Ad Spend trends, company guidance, analyst expectations and the charts show Communication Services continuing to lead the market. We still like GOOGL and META to beat Q4 and guide well.

AMZN played out exactly like we predicted in the last article. We still like AMZN. Growth rate in Ads business, Strong Retail quarter in Q4, AWS looking less negative than H1, continued expense control all point to another robust quarter and guide.

Tech sector: Apple is the unknown here. MSFT, NVDA, AVGO, SaaS and Cybersec standouts should continue strength in Q4 though many valuations are very stretched. We are cautious here

Utilities are expected to see the second best earnings growth. We don't have any favorites and prefer to play XLU.

Materials: after a decent run in base metals. we are neutral in the sector. China is struggling to improve its economy and that is the biggest buyer for the miners.

Industrials: Still like Defense on strong book to bill. We expect defense spending to continue to ramp in 2024.

Healthcare: GLP-1 prescriptions are growing strong and this is still very early in its cycle. We still like LLY and NVO and will add on pullbacks.

We will hold out thoughts on Financials until earnings.

We will publish an update after the new year as we get closer to earnings kickoff and the pre-announcement cycle and economic data weigh in on estimates.

As always, these are thoughts that drive our own investments. You should always consult a registered financial advisor to determine appropriate investments. If you like these articles, give us a follow on Twitter, @MonetiveWealth @archna2011