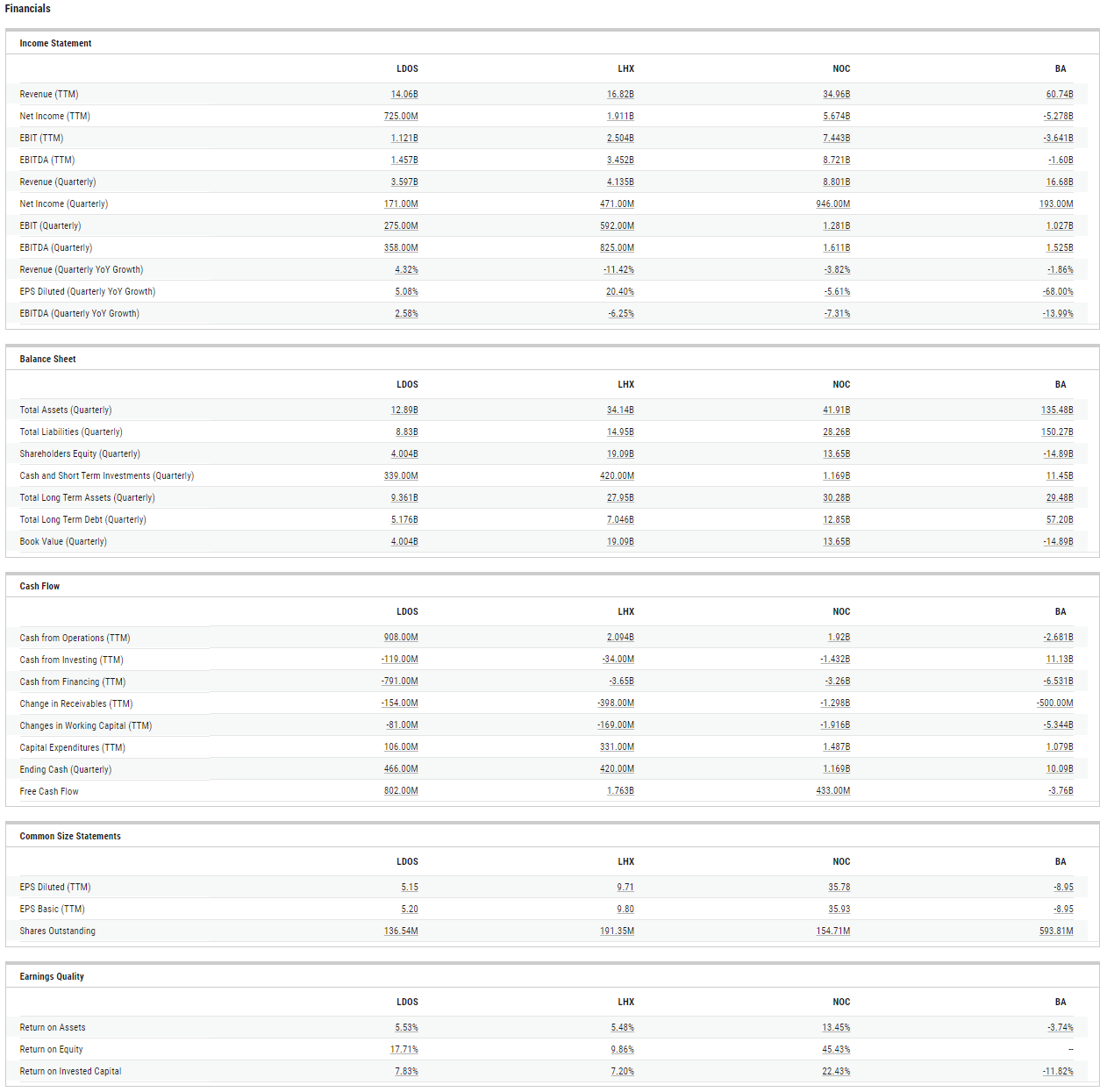

Last week we looked at the Big three: LMT, RTX, GD. LMT has already reported and the stock took off, along with NOC which were discussed in spaces as a trade from the JPM downgrade. That also moved the rest of the big companies up. This week we have RTX, BA, GD and BAH(which we have covered in the Defense Cyber Security post.

Let’s look at today’s list:

Northrop Grumman is a defense contractor that is diversified across short-cycle and long-cycle businesses. The firm’s segments include aeronautics, mission systems, defense services, and space systems. The company’s aerospace segment creates the fuselage for the massive F-35 program and produces various piloted and autonomous flight systems. Mission systems creates a variety of sensors and processors for defense hardware. The defense systems segment is a long-range missile manufacturer. Finally, the company’s space systems segment produces various space structures, sensors, and satellites.

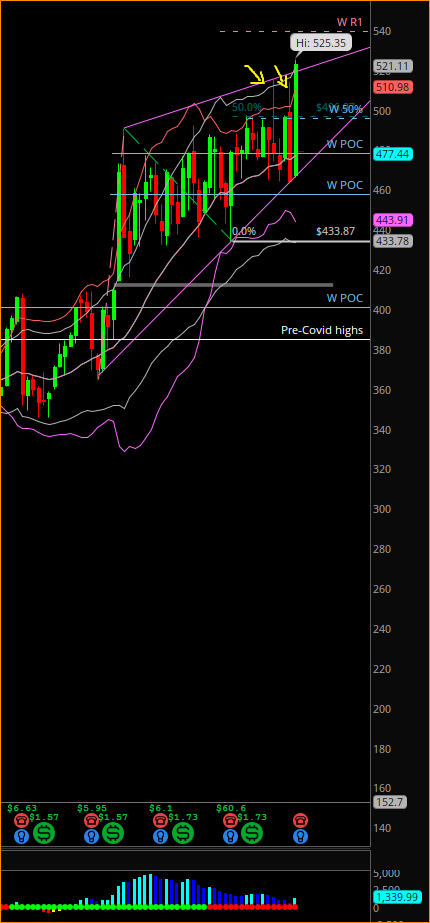

NOC: This past week based on LMT’s earnings, NOC broke out of the ascending triangle. It cleared the previous 2 huge supply/resistance zones pretty convincingly. The weekly TTM squeeze is about to fire. The daily TTM squeeze is already fired.

Technically, the chart looks bullish. The 50% retracement of last week’s range is 495.53. As long as it is above this level, the higher fib target is 539.4

If for any reason, NOC comes back inside the ascending triangle right away then it woulA potential catalyst besides earnings, NOC will unveil the next generation of stealth bombers, the B-21 Raider, in the first week of December. Set to compliment the B2 bomber, the B-21 is a sixth-generation bomber capable of carrying conventional and nuclear weapons over a very long range. The first flight of the type is expected in early 2023. NOC has also been winning contracts in Cybersecurity, Directed Energy, Advanced Radar Systems and Guided Munitions.

NOC: This past week based on LMT’s earnings, NOC broke out of the ascending triangle. It cleared the previous 2 huge supply/resistance zones pretty convincingly. The weekly TTM squeeze is about to fire. The daily TTM squeeze is already fired.

Technically, the chart looks bullish. The 50% retracement of last week’s range is 495.53. As long as it is above this level, the higher fib target is 539.4

If for any reason, NOC comes back inside the ascending triangle right away then it would be a look above and fail setup for lower. But based on Friday’s close and sector strength, this seems unlikely.

I will look at how it behaves in the 516-519 area for a secondary entry.

L3Harris Technologies was created in 2019 from the merger of L3 Technologies and Harris, two defense contractors that provide products for the command, control, communications, computers, intelligence, surveillance, and reconnaissance (C4ISR) market. The firm also has smaller operations serving the civil government, particularly the Federal Aviation Administration’s communication infrastructure, and produces various avionics for defense and commercial aviation.

Analysts are bullish on LHX.

The USSOCOM awarded L3Harris a $3 billion contract in August to provide a fleet of up to 75 AZ-802U Sky Wardens multi-mission aircraft for the program to operate in austere environments with little logistical tail.

In October, LHX received two production orders totaling $235 million to provide leader and manpack radios for the U.S. Army.

LHX: It touched the AVWAP (Anchored Volume Weighted Price- the blue line on my chart) and this past week popped on LMT’s earnings. It has now touched and tested the August 2022 high at 248.5.

A better technical entry for me would be that it pullbacks to 235 (50% retracement of last week’s candle and then pops. This way it would also be a retest of the breakout. If we do not get a pullback but rather a continuation up move then 61.8% fib is at 252 as 1st target, then 264 (78.6% fib). Finally, the 3rd target would be the All-Time-High at 279.71. . Ultimately, in time 300 price target is based on the fibs.

Leidos Holdings Inc is engaged in scientific, engineering, system integration, technical services, and solutions to various government entities and highly regulated industries, including the U.S. Department of Defense, Intelligence Community and the British Ministry of Defense. Areas of focus include intelligence and surveillance, cybersecurity, complex logistics, energy, and health.

In October, LDOS was awarded $1.5b Sentinel Contract. Through this contract, Leidos will utilize Command, Control, Computers, Communications, Cyber, Intelligence, Surveillance and Reconnaissance (C5ISR) capabilities to enhance technological innovation with a focus on rapid insertion of technologies across the mission spectrum, for multiple services, and integrating new technology with existing and legacy systems for enhanced effectiveness.

LDOS: Technically, LDOS’s chart looks totally different from the other defense stocks.

It has touched the 233 WK MA (magenta MA on my chart) and bounced. But it is still below the AVWAP and 100 WK MA. So, this chart looks to be stuck in a range of 88 and 108. It needs to close above 108 for a possible test to its All-time-highs at 125.84

We consider Boeing as work in progress. They are still a very high risk play given the heavy debt load and slow progress in 787 and 737 Max programs. However the restarting of 787 deliveries in Q2 could be the start of a reversal of fortunes for the company.

Boeing is a major aerospace and defense firm. The firm operates in four segments, commercial airplanes, defense, space & security, global services, and Boeing capital. Boeing’s commercial airplanes segment competes with Airbus in the production of aircraft ranging from 130 seats upwards. Boeing’s defense, space & security segment competes with Lockheed, Northrop, and several other firms to create military aircraft and weaponry. Boeing global services provides aftermarket support to airlines.

BA: Has had a lot of issues. That shows up nicely on the charts too. 146.56 is the 100D MA and there is a gap fill higher at 155.19 to 157.45. Then we also have the downward leaning 233D Ma at 169.48. There is so much overhead supply on BA that, any big gap up will find sellers.

As always these posts are meant to be informative and educational are not a recommendation of any of the tickers mentioned. Please consult a RIA or your financial advisor before you invest.

You can follow us on Twitter @Monetivewealth @Archna2011 for more content and updates on our posts and our trades.