March CPI is behind us as well as a stronger than expected PPI. Earnings are underway and the losses from Russia are unfolding in banks. Every morning brings dozens of price target downgrades from Analysts and the earnings guidance is probably going to show more downside rather than upside. Retail sales were not strong and there is definitely more confirmation of continued supply chain disruption

As we await FAANG+T earnings and the FOMC, the picture does not look too good for most of the sectors. When we wrote here prior to FOMC we postulated that a neutral fed would provide a few weeks of relief rally which would fizzle out with earnings season under way. The rally while it happened, was less than we expected and it has all but died out. We correctly called it a bear market rally and not a change of direction. The bears are still firmly in control of the markets.

This brings us to the topic of this writeup. American consumer is still holding strong and we are after all a consumption driven economy. In all this negativity there are pockets of strength that have outperformed and given the sector macros, should continue to outperform in the coming months. Lets take a gander at the sector strength and dive into opportunities they present.

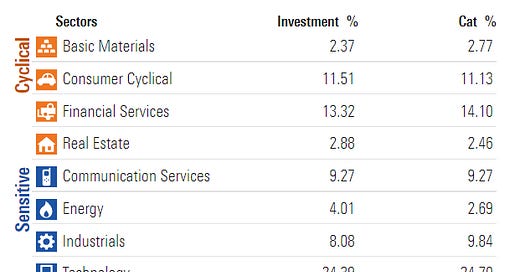

This table below is S&P500 weighting by industry/sector. I am putting this out there to show that markets/indexes will not move unless the heavyweights (ie) tech, financials, healthcare move up. The rest of the sectors don’t carry much weight. For example all time highs in Energy, Utilities and Materials has done nothing for the markets since their combined weighting is under 8%.

Sector performance shows remarkable consistency for the past year. Money has been chasing Energy, Materials and Defensive sectors like Utilities and Staples.

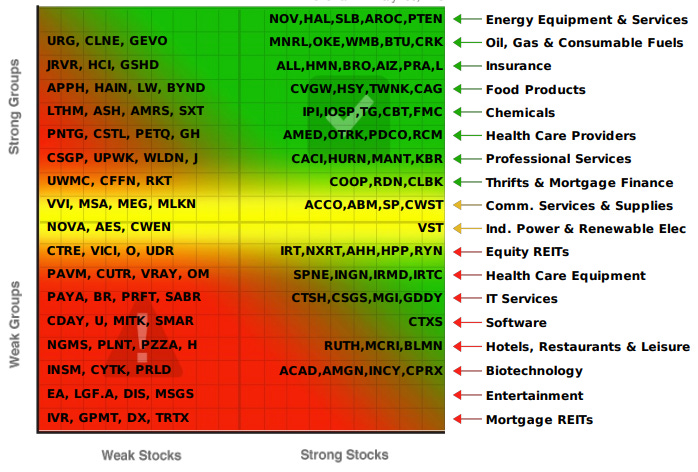

A look at what the Chaikin Power Grid for Russell 3000 shows today.

vs one month prior:

We see minor rotation but remarkably the same sectors have been outperforming consistently. Within the sector there is rotation to a different industry which is why we look very closely at sub-sectors for rotation. Dont give up on a sector that has moved. Dig deeper and find related areas that are yet to fully price in the sector macro.

You don’t need to waste your time reading this if we were to tell you to go buy into strength and invest in energy, materials and Defensive super-sectors. That much is obvious from any data you look at. Since you are here, we are going to give you some more contrarian ideas.

We called the bottom on biotech a few weeks ago but this has gone nowhere. We still like this call and we are putting our own money into the sector.

We see some great potential in Defense & Aerospace with the geopolitical situation. LMT Reports this week and we will be looking there for clues.

We see some interesting opportunities in Regional Banks because we think that the long end of the yield curve will move up and the banks will be very profitable in the upcoming quarters.

FAANGS have underperformed the market and could be in for a reversal if earnings and guidance come thru. This could also be an early sign of reversal for the growth sector, especially ones that beat & guided up last quarter.

As the headline suggests, there is really not much conviction longs here. The most high percentage trades we see are all on the short side. We do love contrarian approaches at Monetive:

Short Big Pharma: We think big pharma is overextended by a lot and is likely to pull back enough for a very profitable trade on the short side. We also think at a big picture level they have to buy growth and will be active in M&A. We think the beneficiary here will be the biotech, just one more reason we like biotech long.

Short Utilities: Besides dividend, there is really nothing going for utilities, Certainly not at these valuations. Coal, Uranium, Oil and Nat Gas costs are going to bite their bottom line and for many of them, they cannot pass on all of the cost increases to their customers. We believe they are ripe for a pullback

Short Staples: Desperation to participate in the market and to at least deploy some of the cash has investors running up valuations of consumer staples. At this time the economy is still strong and recession if and when it comes, cannot really support staples much beyond their current multiples. We feel the downside is greater than upside.

These are all trades with a short leash. Certainly not a set and forget situation, they need to be constantly managed.

Here is market-wide that could provide potential short opportunities. Screening Criteria:

Over $5B in valuation

At or near all time high

Forward PE is greater than 5 year Median PE (stock is richly valued compared to its own historical valuation).

We are by no means suggesting you should short these companies. This screen is an example of the process we use to create opportunity watchlists, in this case on the short side.

(right click and open image in a new tab to make it more readable)

As always we end with a disclaimer. There are only trade ideas not recommendations. Please consult your financial advisor and do your own due diligence before you invest.