Next Generation Defense Technology

Unmanned Systems, Electronic warfare, Mission critical technologies: In this 3rd article on on Defense Industry we look at next generation defense equipment and technology.

When it comes to the defense industry, technology is advancing by leaps and bounds. Some of the innovations that were once considered downright futuristic are now very close to operational rollout. Identifying the technology trends that will shape the future of the defense industry is complex. It can be hard to determine which breakthroughs are most likely to make their way into tomorrow’s defense solutions.

Looking at the technologies attracting investments on other markets and assessing their economic viability is one fact-based way of gaining insights into the future of defense technologies. Robotics, artificial intelligence, unmanned systems, cybersecurity, directed energy weapons are all areas of substantial activity and research and interest to Defense departments around the world.

This trend will be a huge boon to tech sector, however keep in mind that the business from the military and governments might not move the needle for large tech companies. We will instead look at players that are primarily defense vendors who are helping deploy equipment and technology to take defense forces into the next generation. The part of the defense market is still controlled by the premier defense companies like Lockheed, Raytheon, Boeing, Northrup, BAE Systems , Leidos. We will discuss them in the last article in this series since they are pervasive in all parts of the industry. We will focus on the smaller players that have some unique value propositions and are likely to likely candidates for acquisition by larger players

AeroVironment (AVAV) operates under a single business segment in which it supplies unmanned aircraft systems, tactical missile systems, high-altitude pseudo-satellites, and other related services to government agencies within the United States Department of Defense as well as the United States' allied international governments. The systems can help with security, surveillance, or sensing, and provide "eyes in the sky" without needing an actual person, or driver, in the sky.

AVAV has 3 primary business segments aimed at Federal sector.

Unmanned Aircraft Solutions: UAS produces small and medium drones that combine powerful sensing and secure communications, superior aerodynamics and intuitive ground control systems for manual and autonomous flight. Vast majority of the unmanned aircraft in US DoD inventory are from AeroVironment.

Tactical Missile Systems produces Loitering missiles (Switchblade 600 and 300) and Loitering reconnaissance system (Blackwing).

Unmanned Ground Vehicle Solutions. The acquisition of Telerob’s UGVs safely and effectively perform a variety of dangerous missions, including explosive ordnance disposal (EOD), hazardous materials handling (HAZMAT) and chemical, biological, radiological and nuclear (CBRN) threat assessment. Telerob’s ruggedized UGVs feature all-terrain capabilities and offer specialized, precision manipulators, autonomous functionality and intuitive operation to deliver a high degree of mission flexibility.

Switchblade Loitering missile and PUMA 3AE systems are being used with great success against Russia in Ukraine. Here is a link to how Loitering munitions are making a difference in Ukraine Conflict. https://insideunmannedsystems.com/up-close-with-wahid-nawabi-ceo-chairman-and-president-aerovironment/

Some recent deals involving AVAV

$6.2m PUMA 3 AE Unmanned Aircraft systems contract by US Marine Corps

$8.5m PUMA 3 AE Unmanned Aircraft systems foreign military sales

$10.5m PUMA LE Unmanned Aircraft systems foreign military sales

$4m Small Unmanned Aircraft systems foreign military sales

$20.3m Switchblade 600 Tactical Missile systems contract by a US Special Operations Command

Company Presentations:

https://investor.avinc.com/static-files/ac5b4f77-5844-4ce3-a46e-d7e66b009bd4

https://investor.avinc.com/static-files/84d14d49-41c0-4a47-919e-87c4f8b61b43

Elbit Systems (ESLT) is a technology company involved in producing a portfolio of systems and products for aircraft, land, and naval applications. The company's products are primarily used for defense, homeland security, and commercial flight capabilities. Its systems and solutions may be installed on new platforms, or it may perform a comprehensive modernization program to transform a platform. Elbit Systems gives instructions to its customers on proper maintenance of its products and will provide support team specialists when the customer cannot fix a problem. The company markets its systems and products as a prime contractor or as a subcontractor to government, defense, and homeland security contractors worldwide.

Company Presentation: https://elbitsystems.com/media/Elbit-Systems-Investor-Conference-2022.pdf

ESLT business activities include:

military aircraft and helicopter systems;

commercial aviation systems and aerostructures;

unmanned aircraft systems (UAS);

electro-optic, night vision and countermeasures systems;

naval systems;

land vehicle systems;

munitions;

command, control, communications, computer, intelligence, surveillance and reconnaissance (C4ISR) and cyber systems;

electronic warfare and signal intelligence systems; and

other commercial activities.

Recent Orders:

$33 Million Contract to Supply Enhanced Flight Vision Systems for Boeing 737NG

$660 Million Contract to Supply Intelligence Capabilities for a Country in Europe

$80 Million Contract to Supply DIRCM and Airborne EW Self Protection Systems for a Country in Asia-Pacific

$548 Million Contract to Supply Multi-Domain Combat Networked Warfare Capabilities to a Country in Asia-Pacific

$220 Million Contract to Supply Airborne Precision Munition Solution to a Country in Asia-Pacific

$70 Million Contract to Provide EW Solution to an International Customer

$69 Million Contract to Provide EW Systems to a Country in Asia-Pacific

Company Presentations:

https://elbitsystems.com/media/Elbit-Systems-Investor-Conference-2022.pdf

https://elbitsystems.com/media/Elbit-Systems-Investor-Overview-May-2022-accessable_compressed.pdf

Kratos Defense (KTOS) develops and fields transformative, affordable technology, platforms, and systems. Its segment include The KGS segment is comprised of an aggregation of KGS operating segments, including its microwave electronic products, space, training and cybersecurity, C5ISR/modular systems, turbine technologies and defense and rocket support services operating segments. The US reportable segment consists of its unmanned aerial, unmanned ground and unmanned seaborne system products.

Kratos operates 4 business segments:

Unmanned Systems: Manufactures Tactical UAV's: Valkyrie, Mako and Gremlin; UAV Command Systems produces full ground command and control (GCS); Advanced Turbines develops and manufactures high performance jet turbines for cruise missiles and unmanned aerial systems.

Space Systems segment: Kratos has deep experience delivering a large set of integrated products, antennas, and equipment as a system for customers looking to implement large solutions, such as ground stations and gateways, for a range of applications, including Telemetry Tracking & Command, satellite communications, and spectrum regulation.

C5ISR Systems: Integrated systems supporting strategic missile defense, space, and ground-based radar programs; EMI Shielded command & Control platforms; Turnkey ground control systems for unmanned systems; Fabrication of combat systems including radar thread simulators and directed energy weapons.

Warfighter Readiness: Simulation Systems and training platform; Training Services including curriculum development, aircrew training centers and sustainment services.

Some Recent Orders:

$20 Million Unmanned Aerial Drone System Production Contract

$14 Million Tactical Jet Drone System Contract Award

$54M Task Order to Develop a Low Cost, Limited Life Engine for Attritable and Expendable Systems

Contract from U.S. Army Future Command to Demonstrate Military SATCOM Modernization

SKY Perfect JSAT Jointly with Kratos Awarded Contract to Build C-band Spectrum Monitoring Facility for the Japan Ministry of Internal Affairs and Communications

$20 Million International Drone Contract for Production Aircraft, Support Equipment, and Services

$50 Million Contract Value Increase for C5ISR Program System Hardware Platform

$14 Million in Contract Awards for Drone System Logistics Support, Spares, and Consumables

$50 Million Sole Source Contract Option Award for 65 Production BQM-177A Aerial Target Drones from U.S. Navy

Company Presentations :

Mercury Systems (MRCY) is the leader in making trusted, secure mission-critical technologies profoundly more accessible to aerospace and defense. Technology expertise includes trusted manufacturing, safety-certification and secure sensor processing.

Leader in adapting commercially developed silicon technology to be purpose-built specifically for aerospace and defense.

Highest performance and densest processing solutions available onboard military platforms.

Safety-certifiable processing systems up to the highest design assurance levels.

Advanced packaging and cooling technology.

Industry-leading embedded security capabilities and secure manufacturing facilities.

Most advanced open middleware and software allows customers to port their applications on top of open mission systems architecture.

Company Presentation:

https://ir.mrcy.com/static-files/da32da08-f844-49bb-8dc0-39deef4d2ebb

https://ir.mrcy.com/static-files/e6cf817d-f556-4cc4-907d-eb1774ebf2fc

The companies below are European Defense companies. The Ukraine war has created an urgency to be better prepared for a potential escalation in war close to their borders. The local companies will likely be the biggest beneficiaries of this buildout as each country individually and in collaboration with NATO deals with the new geopolitical reality. In the words of an industry CEO “Current geo-political uncertainty, brought about by Russia’s invasion of Ukraine, has highlighted the need for increased defense expenditure, particularly amongst European members of NATO. More broadly it has highlighted the need for countries to re-equip and modernize their defense capabilities to meet the threat of peer on peer conflict."

Chemring PLC (CMGMF) is a defense technology company. The company's operating segment includes Sensors and Information and Countermeasures and Energetics. It generates maximum revenue from the Countermeasures and Energetics segment. The Countermeasures and Energetics segment is engaged in the development and manufacture of expendable countermeasures for air and sea platforms, cartridge/propellant actuated devices, pyrotechnic devices for satellite launch and deployment, missile components, propellants, separation sub-systems, actuators, and energetic materials. Sensors and Information segment is involved in electronic warfare, chemical and biological detection, explosive hazard detection and technology and data science.

Interim 2022 highlights

H1 2022 performance was in line with the Board’s expectations with strong performance in both segments

Roke continued the recent trend of double digit growth in orders, revenue and operating profit in a positive market

Sensors & Information underlying operating margin increased from 20.6% to 21.5% driven by the growth in the higher margin Roke business

Countermeasures & Energetics underlying operating margin increased from 15.6% to 16.4% due to improved operational execution across the segment

Continued reduction in net debt with strong operating cash generation and cash conversion of 101% (H1 2021: 96%). Net debt to underlying EBITDA of 0.23 times (H1 2021: 0.5 times)

https://www.chemring.com/~/media/Files/C/Chemring-V3/docs/annual-sustainability-report-2021.pdf

Hensoldt AG (HAGHY) is engaged in the business of providing defense and security electronics. Its product categories are Radar, IFF & Comms, Optronics, Spectrum Dominance, Avionics, and Integrated Solutions. The company operates in two segments: Sensors and Optronics, of which the majority of its revenue comes from the sensor segment. Its sensor segment provides system solutions and comprises the three divisions Radar, Identification Friend or Foe (IFF) & Data Communications (COMMS), Spectrum Dominance & Airborne Solutions, and Customer Services. Its geographical segments are Europe, Middle East, Asia-Pacific, North America, Africa, LATAM, and other regions.

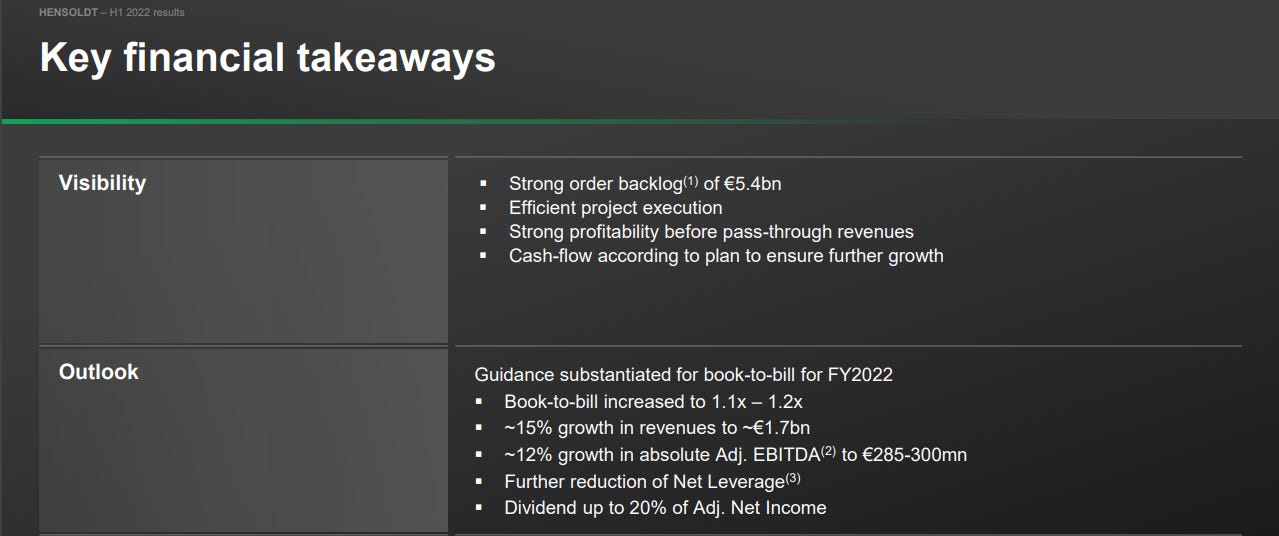

The results for H1 2022 were strong:

Strong 40.3 percent revenue growth in first half of 2022 to EUR 682 million

Adjusted EBITDA improved by 37.7 percent to EUR 61 million

Adjusted EBITDA margin of 8.9 percent at similar level to prior-year period

Strong order intake of EUR 948 million in the first half year

Book-to-bill ratio revised upwards for 2022 financial year

QinetiQ Group PLC (QNTQF) is a company operating in the global aerospace, defense, and security sectors. The services and products offered are air (air engineering services, air traffic management, safety, and environmental management); C4ISR (communication, reconnaissance, intelligence and surveillance, space security, fast jet sensor fusion training, sensors, cyber and data science among many others); Cyber (accreditation support, security health check, data classification, insider threat management among others); Maritime (Maritime Autonomy Centre, Naval Mission Systems, Maritime Stealth among many others).

QinetiQ was formed in July 2001, when the Ministry of Defense (MOD) split its Defense Evaluation and Research Agency (DERA) in two. The smaller portion of DERA, was rebranded Dstl (Defense Science & Technology Laboratory). The larger part of DERA, including most of the non-nuclear testing and evaluation establishments, was renamed QinetiQ and prepared for privatization. QinetiQ became a public private partnership in 2002 with the purchase of a stake by US-based private equity company the Carlyle Group. In 2003, QinetiQ signed a 25 year long term partnering agreement (LTPA) under which we provide UK MOD with innovative and realistic test and evaluation of military and civil platforms, systems, weapons and components on land, at sea and in the air. In February 2006, QinetiQ was successfully floated on the London Stock Exchange and the Carlyle Group sold its stake in the company.

QinetiQ activities include Robotics & Autonomy, Secure communications & navigation, Sensing & processing data, Advanced Materials manufacturing. AI, Cyber defense and warfare, Novel weapon systems, platform design .

Company is building on strong performance in FY22 (results below) and carrying that momentum in FY23. Order intake is strong and there is better visibility on revenue. They are tracking on their goal to improve profit margins to 12-13%.

https://www.qinetiq.com/-/media/d28c1d87a04a4a8e8d290ee949eb46e1.ashx

Some interesting reading on how technology impacts Defense & Security

https://www.brookings.edu/research/forecasting-change-in-military-technology-2020-2040/

https://www.pwc.com/gx/en/ceo-survey/2020/trends/defence-trends-2020.pdf

In the next post, we will look at the large defense players and an overview of the Defense Industry and their prospects in the coming year

If you like these writeups, please follow us on twitter @monetivewealth @archna2011.

As always, these are not trade recommendations. They are part of our research into sectors and industries that we are currently investing in. You should consult an RIA and do your own due diligence before risking your capital.