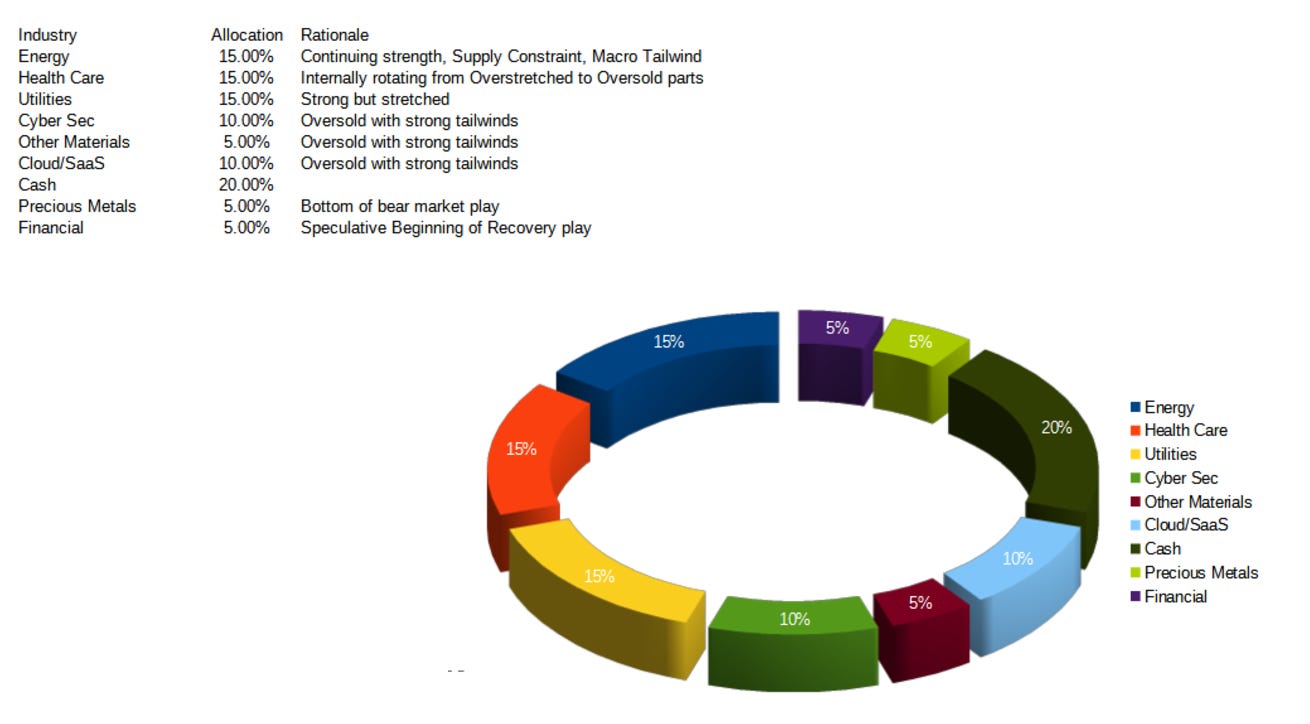

This third article in the series ties together the concepts from the first 2 and presents our portfolio allocation and our picks. It was posted on Monday at Barchart.com

In the first article in the series, posted 2 weeks ago we revealed our portfolio allocation in the current market. We highly recommend you read the 3 articles in order so you can better understand our approach to investing.

Lets quickly look at each sector.

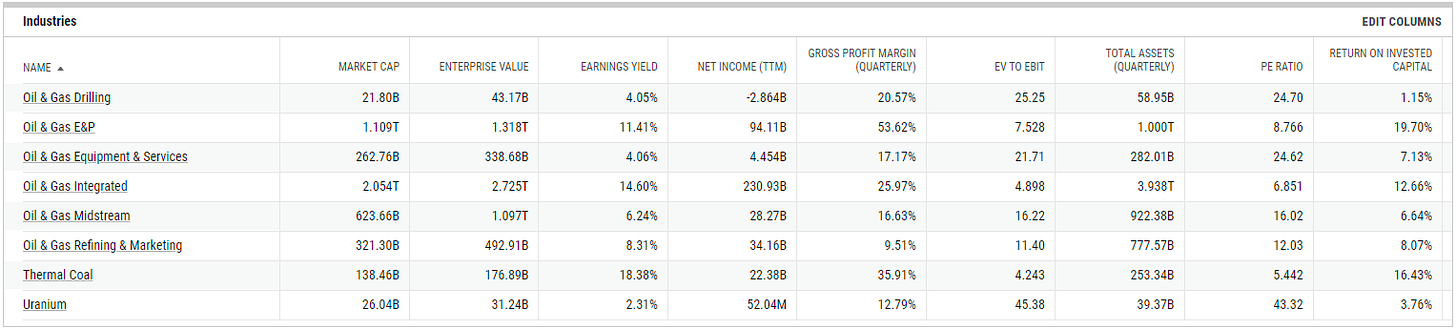

Energy: Our preference in the sector in Integrated Oil and Gas plays

The Oil Majors, XOM, CVX, SHEL, TTE, EQNR. BP, E, SU. Negative Environmental impacts, years of underinvestment, sanctions against the largest producers (Venezuela, Iran, now Russia), war and internal disturbances in Africa are some of the biggest reasons that Oil is structurally undersupplied for many years. The rapid growth of shale oil has covered this deficit in a big way and with actions against shale and cost economics in the past 2 years, shale production is also not keeping up. We have the perfect storm of returning demand and production not moving up and OPEC successfully refraining from over producing. We think that oil is not likely to go back to the 50’s any time soon. Adding in the extremely limited capacity in refining, and the ability of downstream units to pass on costs to consumers, we like Integrated Oil that has E&P, refining, transportation, trading and downstream chemicals. In addition they are also investing heavily in green energy and actively buying back shares and paying down debt. They also have relatively lower cost of production in both Oil and Gas. We like Oil Majors in US and Europe for multi year investment. However demand destruction is a real challenge and we expect Oil and Gas prices to fall substantially in 2023. To this end we are hedging our positions in big oil with commodity shorts in Oil and Gas

***We have taken profit on a third of our position in TTE, E, EQNR, SHEL on June 8th and 9th. Just locking in profits. We still have 11% of portfolio in Energy***

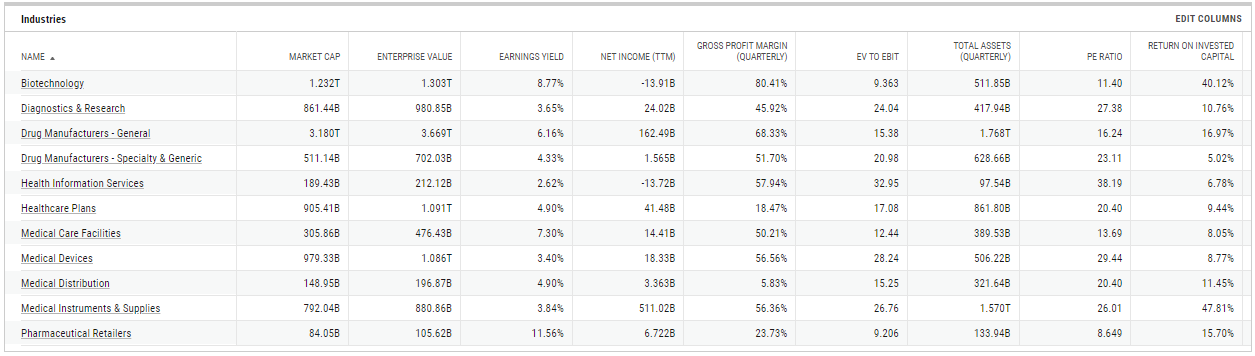

HealthCare: The Pharma industry (Drug Manufacturers) have outperformed the entire sector and the market in the past 6 months. We think they are overextended and the upside is limited.

We have already seen deals happening in extremely oversold biotech space. We have been adding XBI/LABU for a few weeks now but we have been too early in the position. We are now increasing our position size for a very long term hold. We are also researching individual position here and will post an update soon. The most exciting positions in healthcare are related to HealthCare Tech & Medtech Thematic. We have opened positions ETF’s GDOC, PBE while continuing to watch for rotations inside Healthcare sector. As we see entry signals in individual stocks we will rotate in.

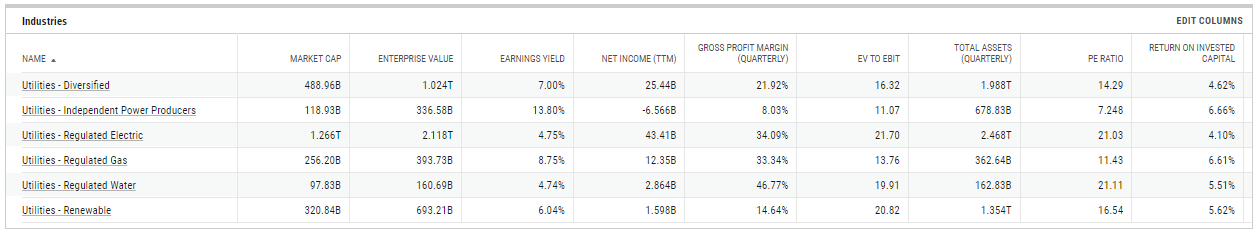

Utilities: This is a safety trade for the current economic cycle. Valuations are stretched and we are looking to take profits on any signs of market reversal to risk-on.

We have positions in XLU and in NRG, PNW, EXE.

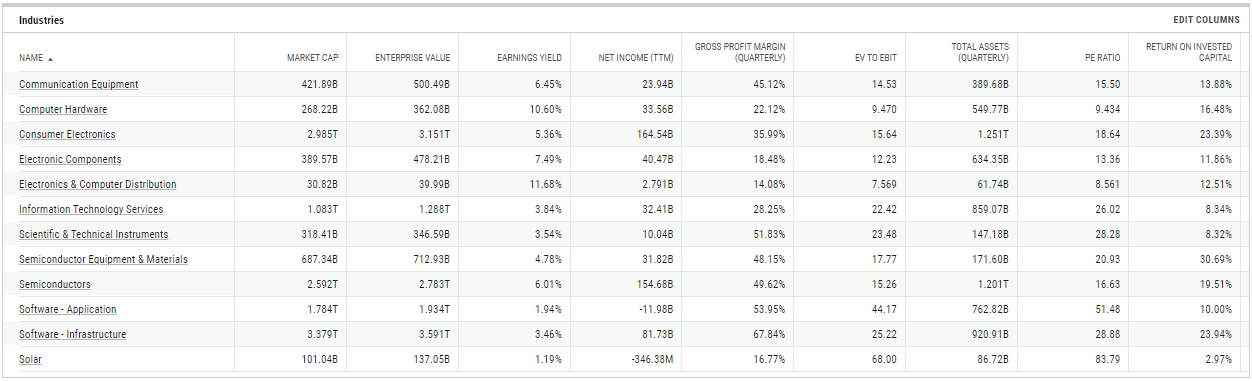

Information Technology sector: We expect extreme volatility to continue until Fed goes on the sideline. Until we see a change in the Macros that will point to Fed neutrality, we are not expecting sustained buying in Tech.

That said, we see pockets of strength especially in Cybersecurity and Cloud/SaaS where the significant pullbacks have made valuations far more interesting from a Risk/Reward perspective. We added AMZN, recently. We also opened positions in MDB, ZS, DDOG, SPLK, VEEV. These are starter positions and we will monitor for opportunities.

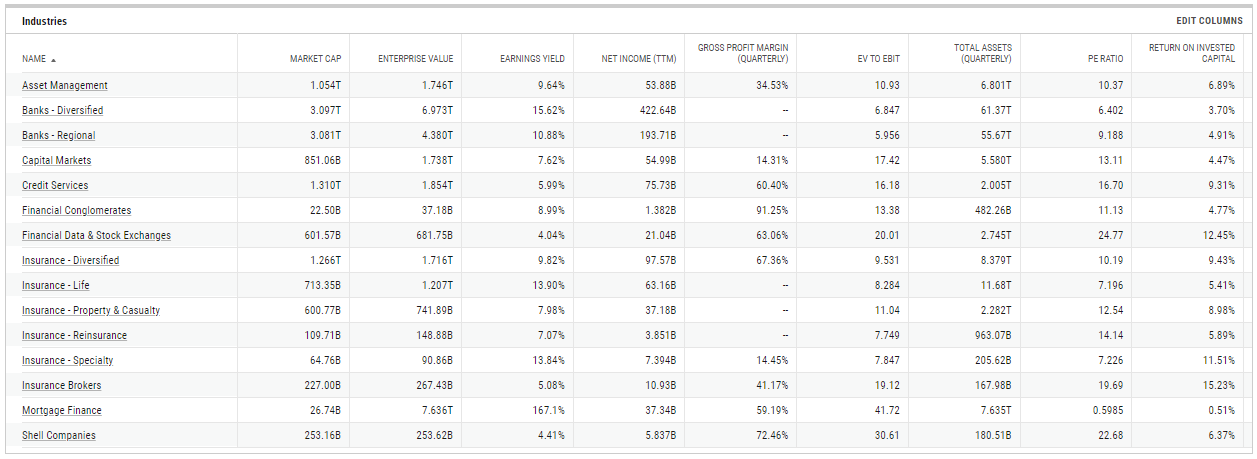

Financials: This sector does not perform well in this part of the economic cycle with an aggressive FED and QT on cards.

As the economy either falls into a recession and then bottoms out, Financials will lead the way out and outperform the market. We have taken very small speculative position given the size of the correction in the sector. We like GS, MS (upcoming M&A cycle beneficiaries) and a couple of regional banks KEY, ZION, SVB, SI

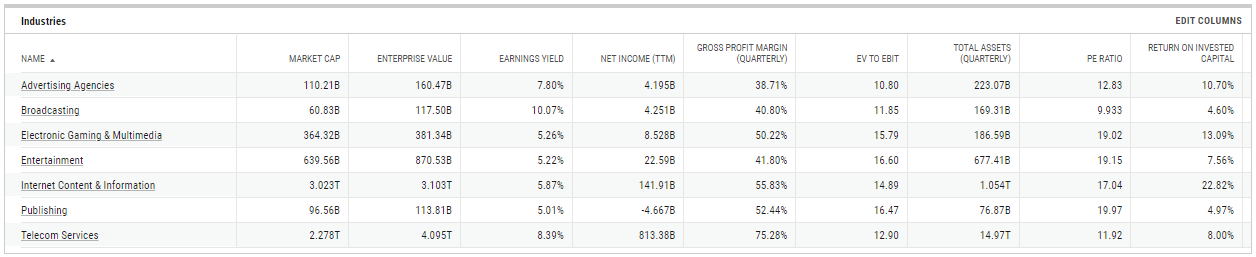

Communications Sector: We do not have positions here but we are watching GOOG and will await Q2 results and guidance to decide how go forward

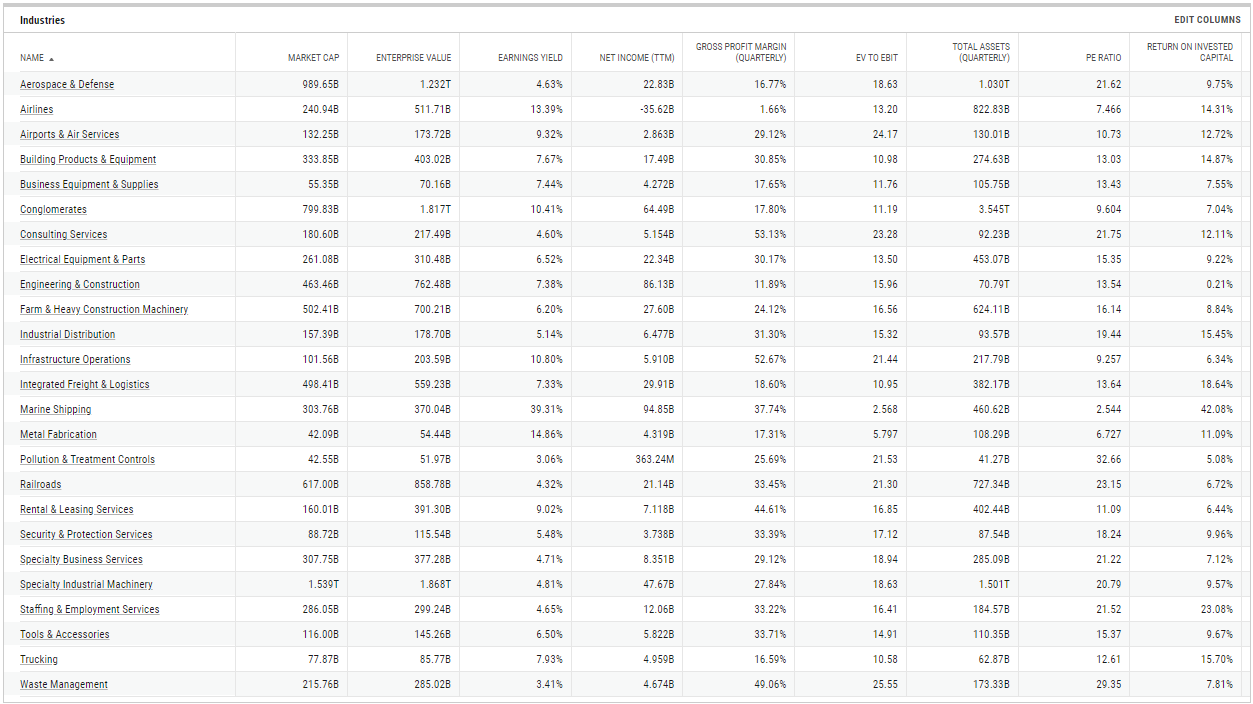

Industrials: We think the sector will continue to underperform especially as the cost of capital is going up. We do not see long term position in the sector for now.

However, the geopolitical situation and current Macros offers trade opportunities in Defense/Aerospace, Agricultural Machinery, Marine Industries.

***Watching Shippers DAC and ZIM for potential add this week***

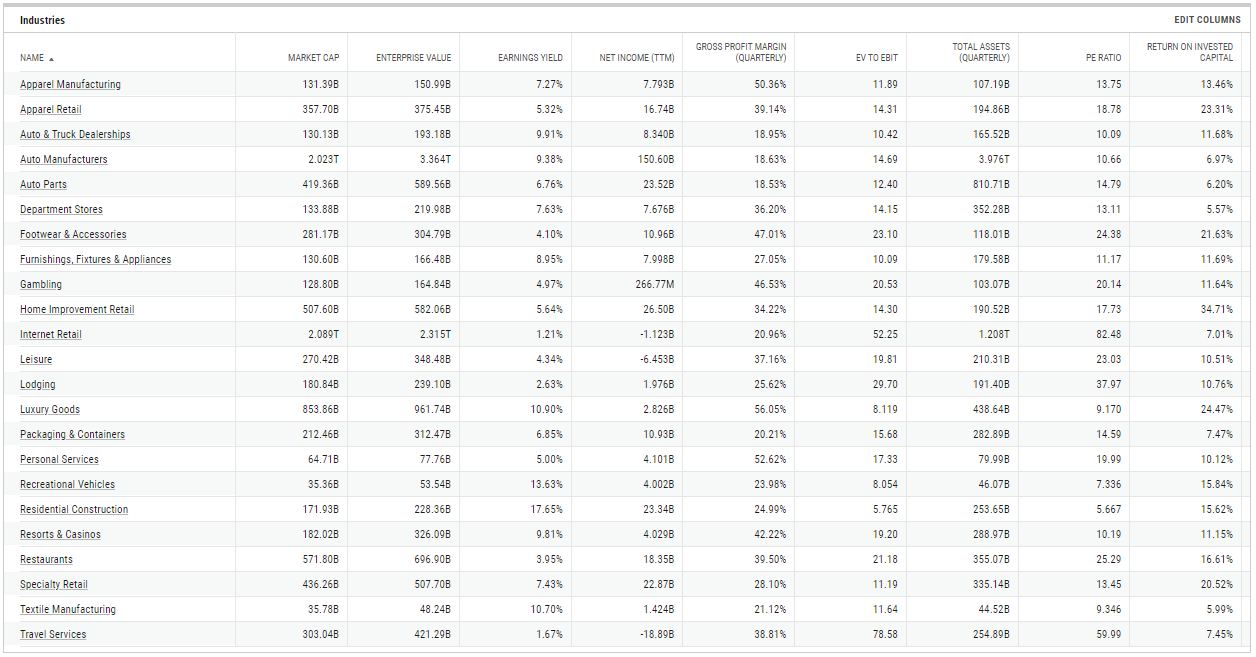

Consumer Discretionary: Another sector that we expect to underperform as the economy slows down or goes into a recession. We do not see long positions here until the economy bottoms. However there are plenty of trade opportunities

We like luxury and the specialty retail sector for trades.

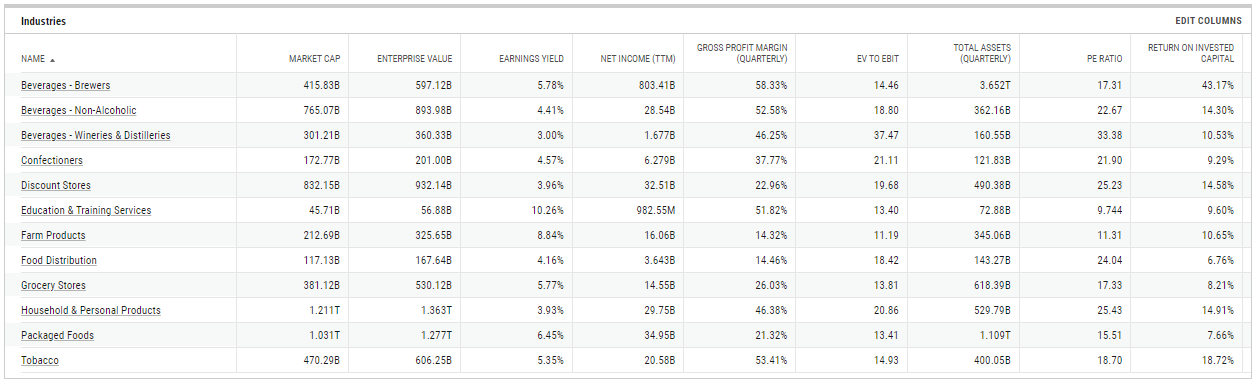

Consumer Staples: This sector has and will continue to outperform in a slowing economy. However we strongly feel that the run up and current prices to not offer an ideal Risk/Reward scenario at this time.

We are only looking at short term trades here for now.

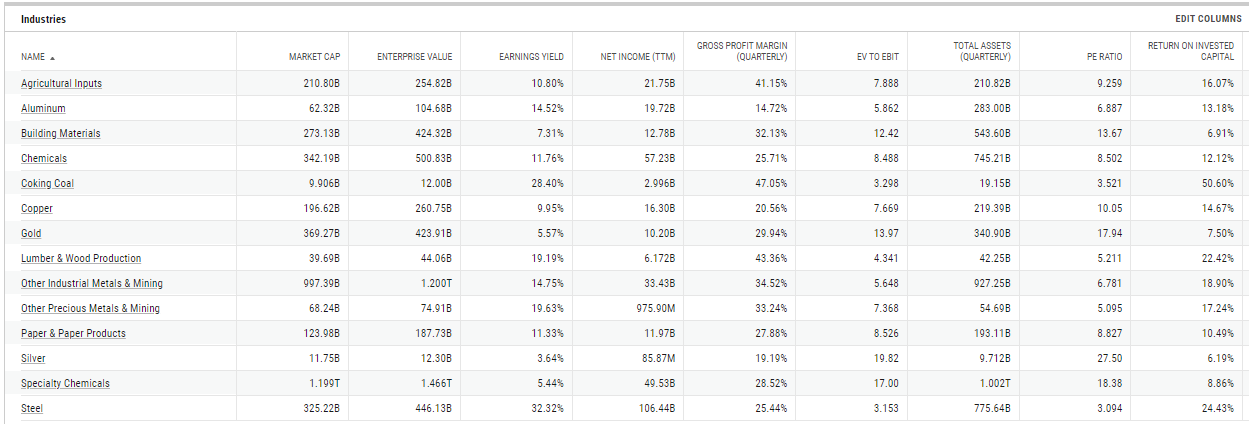

Basic Materials: This sector is benefitting from Geopolitics (Base & Industrial Metals, Agricultural Inputs, Coal, Specialty Chemicals) and current economic cycle (Precious Metals)

In the Metals sector we have long positions in VALE, RIO, SBSW, WPM, NEM, PAAS. If we see further deterioration in the economy, we will add to the positions in precious metals miners. We have trading positions in Specialty Chemicals and Fertilizer/Agricultural Chemicals in LIN, LYB, ALB, LTHM, MOS, NTR, CBT

We are going into a period of heavy economic data and the upcoming FOMC and start of QT all of which could contribute to increased volatility and market choppiness. We are more inclined to trade in this market than add new long positions (other than ones called out above) in these condition. We are using this time to update our watchlist and use that to trade the chop. We are going to review the positioning after the FMOC and Fed policy statements and GDP data.

The holdings mentioned are our positions and not a recommendation. Everyone should consult a registered investment advisor and do their own due diligence before investing.

Archna and I will be updating our thoughts on twitter and available to discuss this or any of our other articles. Please follow us @Archna2011 @MonetiveWealth