Monetive Wealth Model Portfolio Update#2

Trade ideas with secular growth and positive tailwinds from current market situation

We are adding 2 interesting stocks to our watchlist and looking for an opportunity to enter into trade. We will post the trade as soon as we enter.

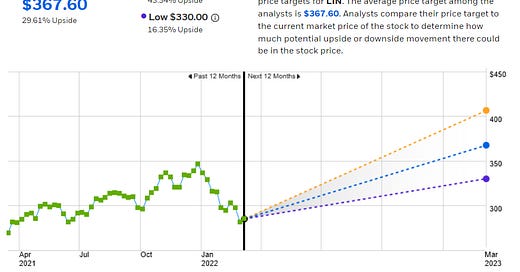

Linde: LIN One of the largest suppliers of Industrial Gases, a big player in the Hydrogen market and a supplier of NEON gas that is critical for SEMI manufacturing. Over 90% on NEON gas comes from Ukraine and that is facing serious disruption. LIN is one of few suppliers in the west that can supply NEON. Halting of NordStream 2 is also a positive .As demand for LNG gas increases amid a scarcity of terminals and plants to produce, process and deliver the gas, there may be an influx of private funds and government subsidies to build LNG terminals and plants, which Linde can profit from.

LIN beat on Q4 Revenue and EPS and guided 2022 Q1 in line.

A quick look at fundamentals: Price multiple are coming back to pre pandemic levels. Profit Margin is healthy and ROCE is trending back up.

Here is the technical chart on LIN:

We are having a falling wedge pattern on the weekly. But not yet ready to breakout of this wedge. RSI indicator is pointing downwards and bearish. StochasticMomentumIndex is pointing up but still negative. So there is still room to the downside. Also, there is a very small gap down close 257-258. The weekly POC is 254.77. POC is point of control (think of it as support since lots of volume has traded there). The current 150 Weekly MA is at 246.64. All these points can easily converge in a couple of weeks to the grey box. That would be my perfect entry.

So, I plan to wait and watch this one. Either it gets to 250 level where I intend to buy or will see if the wedge breakout happens without filling the gap.

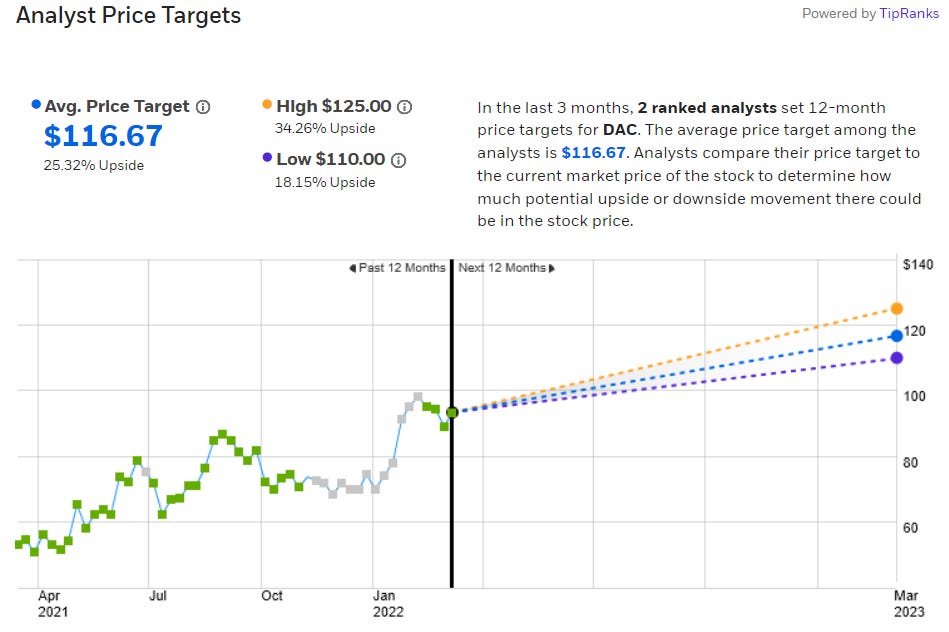

DAC: Danaos Corporation is one of the largest independent owners of modern, large-size containerships. Their fleet of 71 containerships aggregating 436,589 TEUs ranks Danaos among the largest containership charter owners in the world based on total TEU capacity. The fleet is chartered to many of the world's largest liner companies on fixed-rate charters. Geographically, the company operates in Australia-Asia, Europe, and America, with maximum revenue from Australia-Asia region. DAC beat on Revenue and EPS and guided up for Q1

Fundamentals have shown sharp improvement. Container rates are thru the roof and this has led to a huge jump in revenue and kept PE and PE in low single digits. ROCE and profit margins are at or near all time high. Company has a comfortable and rapidly growing cash position. Hapag-Lloyd today said that container rates are unlikely to come down any time soon. This is a big factor in continued outperformance for DAC.

DAC weekly technical chart is shown below. It has bearish divergence on the weekly. Prices have moved up faster while RSI is having lower highs. Due to this we at Monetive want to wait for price to retrace to the weekly POC at 72.

But if it can take out 96.45 to the upside then we are definitely trading it since it can easily test 110 price. 110 is the 2011 highs. That would be our 1st target.

But we are looking to trade these two names on a swing basis hence putting it out there.

Love the post Raja. The discussion on what levels to trade is very useful.

Another super informative post! Thank you, Rajaram!!

Love this new style of sprucing up fundamentals with some TA as well :)