We are debuting a model portfolio here at Monetive Wealth. We are going to be posting actual trades and adjustments as we actively manage the portfolio. We will also be posting the macro backdrop prior to CPI and the FOMC meeting.

Let start with Sector strength data: First table for last 4 weeks & 2nd is 8 weeks:

Some of these sectors have been in play for a month or more. It is important to pick thru the sector to find stocks that still have a good a solid run left. From out of our watch-list we have 2 picks to kick off our portfolio:

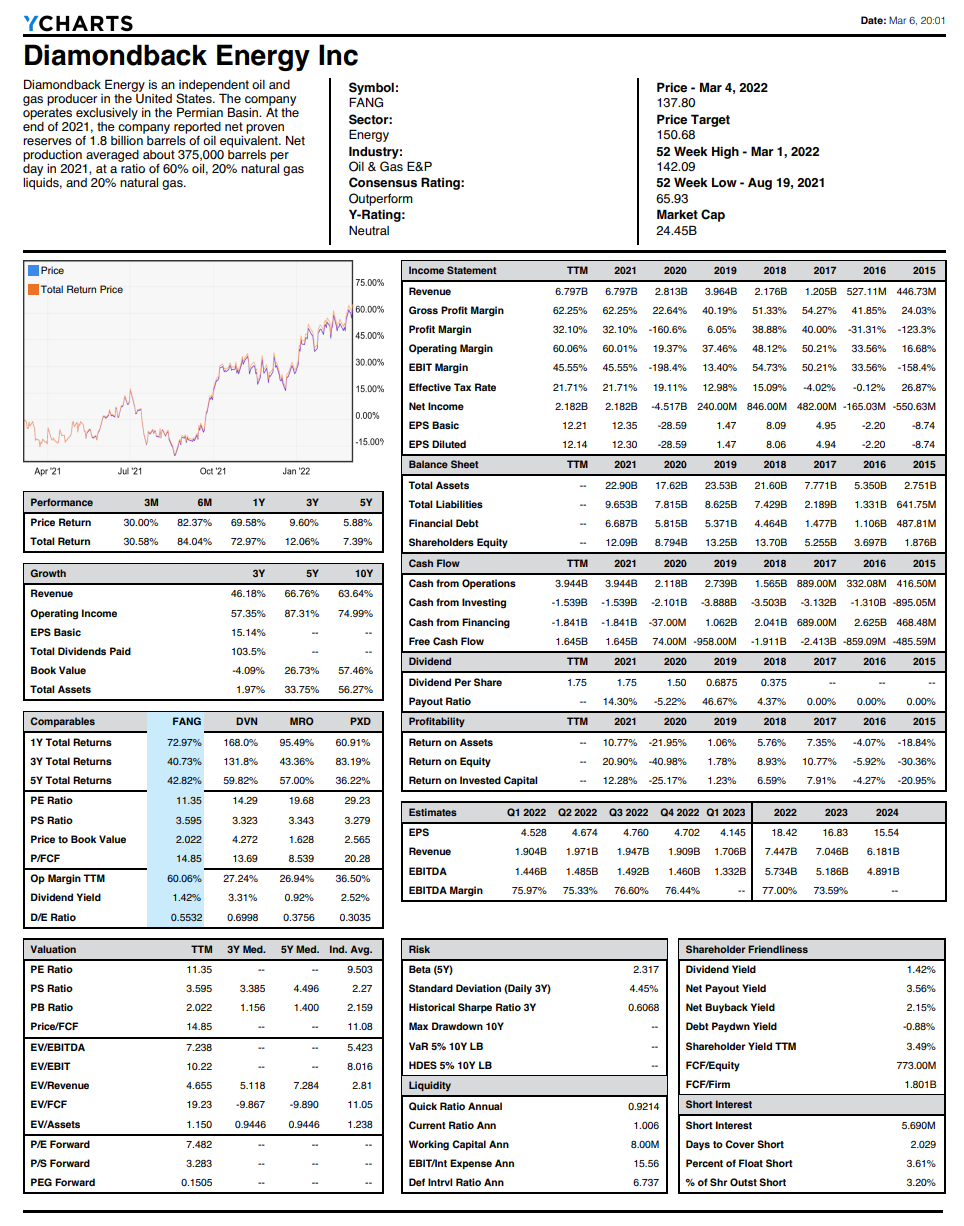

#1: Diamondback Energy: FANG is an Oil and Gas producer. The Company operates in two segments, which include the upstream segment and the midstream operations segment. The upstream segment is engaged in the acquisition, development, exploration and exploitation of unconventional, onshore oil and natural gas reserves primarily in the Permian Basin in West Texas. The midstream operations segment is focused on owning, operating, developing and acquiring midstream infrastructure assets in the Midland and Delaware Basins of the Permian Basin.

FANG multiples are back to pre pandemic levels when Oil and NatGas prices were far lower. The higher realization will go a long way in cleaning up the balance-sheet and We expect the company to come out of this Oil rally to be a much stronger company. Profit Margins are dramatically better than a year ago and revenue growth is strong. They should further strengthen in the coming quarter. FANG has Tipranks consensus rating of strong buy and a price target between $122-$195. Social Sentiment is 100% bullish.

This is the daily chart on FANG. It has not yet broken out like the other energy names like $XOM and $CVX.

So we can look at a stock that can play catch up. We are looking for a quicl long trade this week above 142.09

But, if this takes time to breakout then we want to get into a position at the 50% fib support close to 122. But even a pullback to the weekly point of control at 130 is good for an entry.

#2: Wheaton Precious Metals: WPM: Wheaton Precious Metals Corp. is a Canada-based precious metal streaming company. The Company primarily engaged in the sale of precious metals, including gold, silver, palladium and cobalt. The Company is operating approximately 24 mines and eight development stage projects. WPM has agreements with VALE, Glencore and Goldcorp.

Precious metals streaming is a term for when a company makes an agreement with a mining company to purchase all or part of their precious metals production at a predetermined discounted price to which both parties agree. In return, streaming companies provide upfront financing for mining companies looking for capital.

Fundamentals are solid with Revenue Growth, ROE and Margins pretty solid YOY. They have long term streaming contracts with 17 miners and the current run in prices of Gold & Silver should bring in a big jump in profitability. WPM has Tipranks consensus rating of strong buy and a price target between $44-$63. Social Sentiment is 92% bullish. WPM has earnings on March 11th.

On the weekly chart, WPM has broken out of the downtrend with higher volume. 3/10/22 is its earnings. With gold higher, it is setup for nice move higher.

50, 52.5 and 54.55 are the potential targets on this name.

Friday’s options flow had 2 trades of interest. There was 9K volume for Jan 2023 40 Puts. these were sold. for 3.2 credit. Also there was 1050 contract size of Jun 50C bought on WPM.

Please note these are trade ideas, not recommendations. Please do your own due diligence before you enter into a trade. Always consult a RIA or your Financial Advisor to understand the appropriateness of any investment to your financial situation.