As the world wakes up to war in Europe, let me first say that I pray for the people of Ukraine and their safety. I hope this war ends quickly and sanity prevails

We are at a significant inflection point in the markets. Oil is over $100 and Gas prices in Europe are up 50% intraday. The broader markets are in the correction territory. Risk of runaway inflation is high and the trust in Fiscal and Monetary authorities to create a soft landing seems to be slipping away. Later today we will hear the world leaders response to Russian invasion. That will also add to the uncertainty we face in the markets.

Gold is moving as both a hedge against inflation and as a safety trade. Meanwhile the broader market is falling every day. There is no better time to refocus on what still makes sense. Here is a great reason why:

These are not stock market trends, but much much larger. They are demand driven, secular change that should endure anything but the worst of recessions and even that only to a point. Given the selloff we have already seen and probably what is left to come, these trends are where I see out-performance in coming years. We have heard enogh in the press about the importance of stock picking going forward. Index investing is not going to cut it. The value of picking the right stock is going to make all the difference in market beating returns. This is where I believe that sector rotation along with thematic investing is going to give the edge in the coming months and quarters and also provide a greater protection against drawdowns.

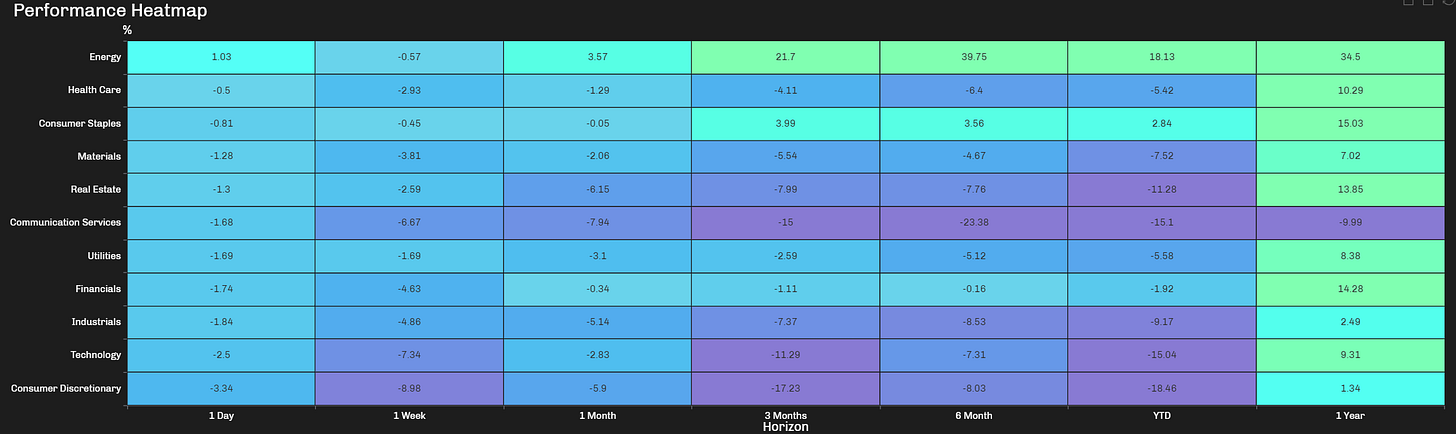

By most measures, we are somewhere at or near the top of the current economic cycle. This data is also borne out by the sector outperformance: As you go from right to left on the table below, you see Industrials, Discretionary and Financials fade. Materials and Energy are the best performing sector by a wide margin. As we get these shockwaves of selling, staples are also getting bid up.

In the next few posts I am going to explore how we trade the economic cycle and sector rotation from out of the stocks participating in one or more longer term themes.

Positioning for long or swing trade is very risky in the current market scenario. Safest plays will be in sectors that have rotation strength and demand strength. Consider these trends with some examples only provided to explain the idea. They are not meant to be recommendations. You should always do your own due diligence and consult a registered investment advisor

Energy: TTE and SHEL are not just benefitting from Oil prices but they are big producers of LNG and specialty chemicals which are also seeing strong pricing power. They also have significant alternate energy investments that are starting to turn around.

Travel & Transportation: This is a reopen play and still has lot of legs left to go. Look at Travel Enablers, Airlines, Aircraft Services/MRO, Speciality Retailers (BKNG, ABNB; LUV, DAL; AAR, GE, RTX; BGFV, WSM) just to name a few

For a shorter time frame, the Geopolitical situation also provides some interesting opportunities to consider in energy especially Nat Gas Exporters, Industrial Metals (Palladium, Platinum Titanium), Industrial Gases (Neon). Together with the rotation strength these stocks could help weather the current sell better than the rest

Defence: DFEN, LMT, NOC, GD, BWXT, RTX, KTOS

Neon: AIQUY. LIN

NatGas Exporters: LNG, SHEL, TTE, ENB, KMI

Platinum& Palladium: SBSW, IVPAF, ANGPY, NMLTF, PLG, VALE, IMPUF

Titanium: ATI, HWM, CC, HUN, KRO

GOLD: NEM GOLD