Thank you for coming back here. Hopefully you are at least curious about sector rotation and thematic investing. So let me give you some more to chew on.

We are now nearing the tail of earnings season and past the first Fed meeting of the year. Markets are in correction territory and growth stocks are deep in bear market levels. On the positive side, Macro Economic outlook is still very positive. GDP is growing over 4% and we are at or near full employment. It stands to reason markets will recover and we should plan for positioning for the coming recovery. This is how I am doing that at Monetive Wealth.

In the first 2 posts I talked about the idea of Thematic Investing and also about Industry 4.0. I will discuss the rest of the themes in this and subsequent posts. I am going to only introduce and define the theme. I will also provide some links to research that go into details on these themes. I will use these posts to connect the theme to the Monetive Investment thesis.

Healthcare Technology + Medical Technology

Health-tech is the fastest growing vertical within the healthcare sector. It includes any technology-enabled healthcare product and service

Med-tech vertical focuses on therapeutic technologies and medical devices that treat medical issues and diagnostic technologies that detect medical conditions

Next Generation Banking

Quoting the American Banker “Digital banking technologies — including artificial intelligence, analytics, personal financial management software, internet of things, voice banking, banking as a service and fin-tech innovation — are converging toward one end goal: invisible banking.

This is banking you don’t have to think about. You tap to pay. You drive out of a parking lot and the car pays the parking fee. You tell the bank you’re saving for your daughter’s college tuition and money is automatically moved from your checking account to a special tuition savings account at appropriate intervals. You’re offered a loan or a discount at the moment you need it, at the time you’re making a purchase. “

A common thread among these themes should now be starting to emerge for the readers: Irrespective of the sectors or industry there is digital disruption and the speed of this disruption is causing significant challenges to the industry and at the same time creating once in a generation opportunities for investors to profit from it. There will be winners in the industry that embrace this transformation and provide these next generation services to their customers. There are also winners among the enablers of this transformation from Cloud Service providers, Cyber Security Companies, Software, Semiconductor suppliers etc.

Lets bring this back to investing. Sector rotation works and provides market beating returns on a consistent basis. We are taking this further by refining what plays within the sector are actually involved in these multi year multi theme transformations and likely to be big winners. Next time you hear about sector rotation in the financial press, you shouldn’t be limited to thinking about the sector ETF or the known leaders. You should have built out a watch-list in each sectors that are likely to outperform because of the tailwind of these secular themes. When you hear a theme being discussed as hot, you don’t have to run out and buy the obvious plays. You want to go back to your watch-list and pick up ones where there is sector strength so you catch the tailwind of the rotation

This simple idea is in essence what I use as the primary stock picking strategy at Monetive. As I research this and other emerging themes the watch-list is continuously evolving. Significant events like earnings, macro factors also bring changes to the watch-list and to the themes.

Hopefully from these posts taken together with stock picks from ArchnaTrades, you are able to find trades that you can take advantage off as long as it supports your risk profile and investment goals.

To get you started with your own research, here are some thematic ETF’s from which to build your watch-lists. This is only the starting point. On a regular basis, will publish updated list of interesting ETF’s to track.

Another resource I have found invaluable in my research is Solactive (https://www.solactive.com/indices/). This is a company that creates and maintains Indexes for a many ETF providers.

Once you have built a watch-list of all the companies in every theme that interests you, sort them by Sector. You can now use this list to find your trades based on sector rotation. Let’s take an example. This is one week sector rotation in S&P500.

Health Care (IXV) is moving from lagging to leading meaning there is some rotation into this sector.

This should benefit Health-tech and Med Tech Stocks an also other Industries exposed to healthcare sector.

Armed with this info, you can go back to the fundamental and technical analysis of stocks in your watch-list in the Health Care sector and pick your long or short. You have the tailwind of sector strength in your favor and the longer secular trend of the theme to support your picks.

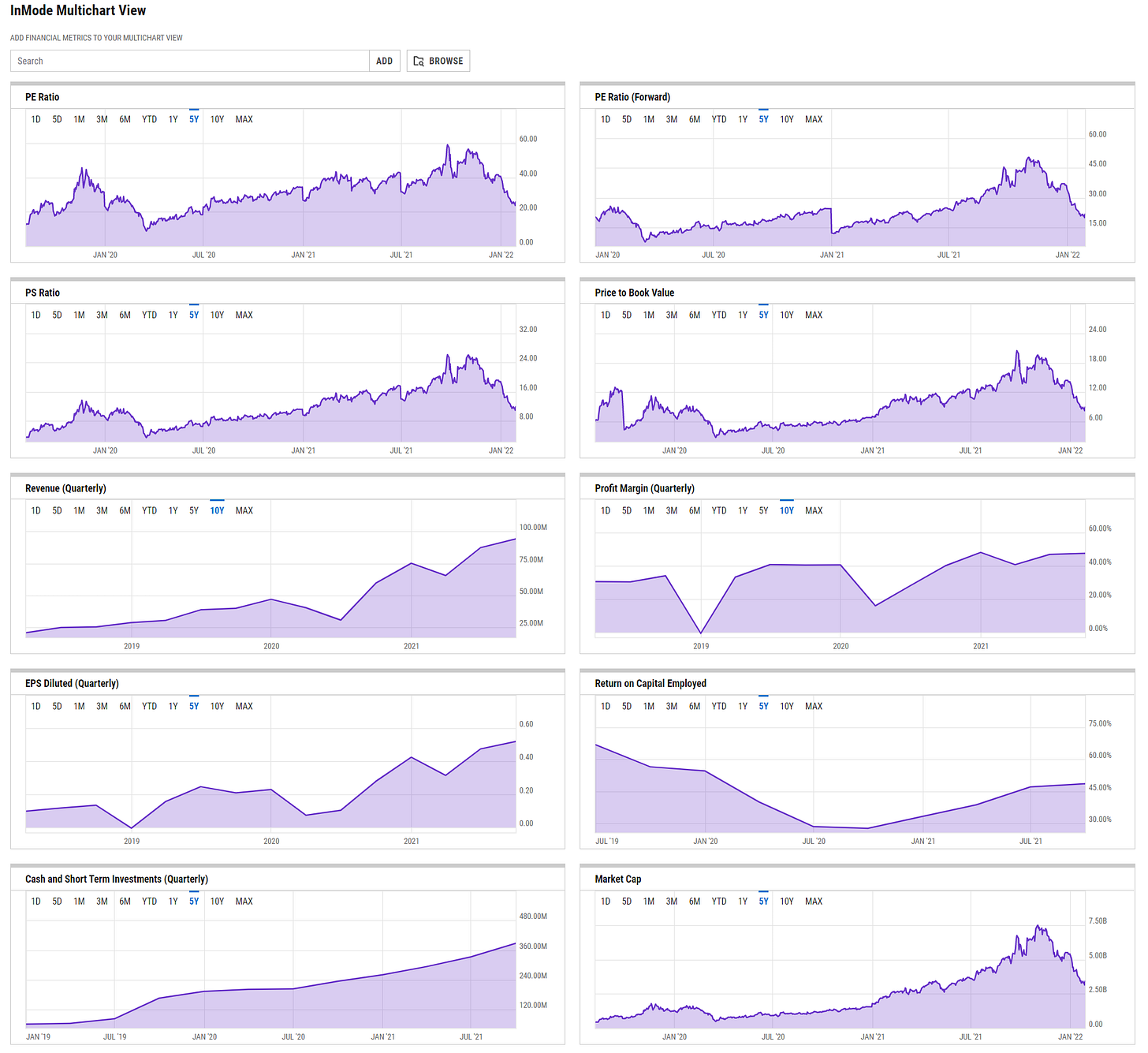

Here is an example: One of the stocks that came through the screen was INMD. once a darling growth stock that fell out of favor.

INMD is profitable company with solid Quarterly Y0Y revenue growth of 57%, EPS growth of 87% and EBITDA growth of 93%. Profit Margin is high and stabilizing, ROCE is improving, Cash on balance sheet is growing and valuations are much more reasonable compared to a year ago.

Healthcare Equipment business should get tailwind from normalization of hospital procedures and removal of covid restrictions. As elective procedures are performed again all over the world, demand for Hospital Equipment will return strongly. If this able to hold the Jan 24th intraday low of 39.27 and bounce, I will be looking to open a swing position depending on how the market macros are playing out.

I want to end this on a note of caution. Going into the March FOMC, we are likely to get the highest CPI reading yet prompting the fed to act forcefully. Caution in very much the watchword here. Plan to have hedges in place and keep a tight stop to get out of risker positions should the Geo-Political situation worsen.

Please always remember this is not investment advice and is not a substitute for your due diligence. You should still consult a registered investment advisor on what is best for you.

Here are some good discussions about the 2 themes discussed here:

https://demigos.com/blog-post/major-healthcare-technology-trends/

https://builtin.com/healthcare-technology

https://thehealthcaretechnologyreport.com/the-top-100-healthcare-technology-companies-of-2021/