Happy New Year!

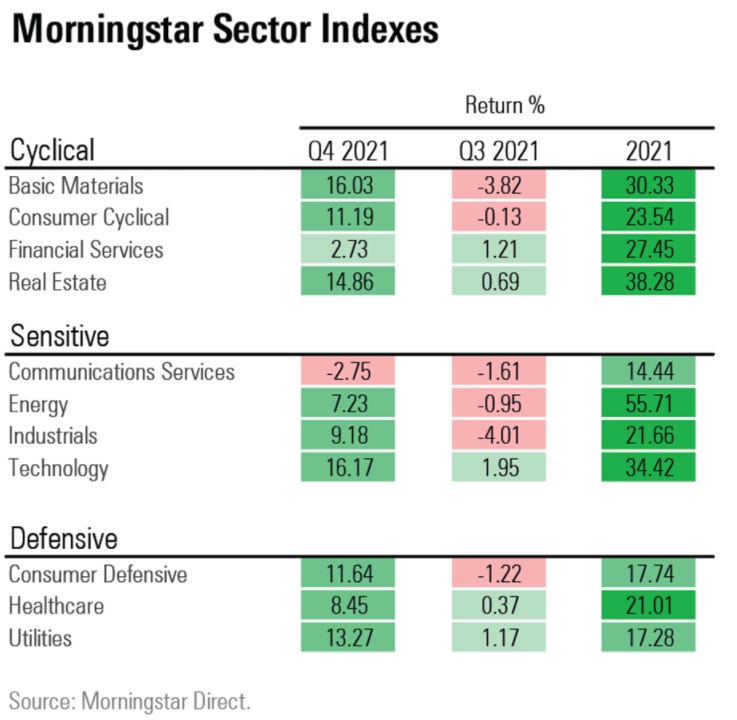

2021 was a phenomenal year for markets. Most sectors enjoyed double digit returns

This year has started out different. Hawkish minutes from the December FOMC have melted down the bond markets and started another round of selloff in the stock markets. With Bank earnings underway, we have 10yr touching 1.8 and eyeing the 2 handle. Yield curves have steepened and 30yr mortgages are up over 3%. To say we have an interesting year ahead would be an understatement. While still dealing with the lingering pandemic and supply chain imbalances, we have the added issue of spiking inflation, receding stimulus and the mid term elections later in the year. This is setting up to be traders market quickly reversing directions as market changing macro factors fade in and out throughout the year. Under these circumstances, buy and hold is not going to cut it especially with high beta stocks. Neither is investing in indexes. Stock picking will be the only way to navigate ever changing risks and deliver market beating returns.

At Monetive Wealth, stock picking and sector rotation has always been the go-to investment strategy. Having the tailwind of market and sector macros along with fundamentals and technicals is how I invest my capital. Over time, I have refined this strategy to include secular long term trends. Let’s dive into the long term trends and see how we can beat the market this year. I highlighted some of these trends in my first write up:

Industry 4.0

Healthcare Technologies

Next Generation Banking

5G

Metaverse

Saas & Cloud

EV Ecosystem

Cryptocurrency

While these trends are expected to last multi years or decades in some cases, the returns are lumpy and unpredictable. At Monetive, the approach is finding companies with exposure to these trends using the tailwinds of sector rotation to time entry and exit.

We will dive deep into these trends one by one starting with Industry 4.0 in this post

Industry 4.0 is the information-intensive transformation of manufacturing (and related industries) in a connected environment of big data, people, processes, services, systems and IoT-enabled industrial assets with the generation, leverage and utilization of actionable data and information as a way and means to realize smart industry and ecosystems of industrial innovation and collaboration. Below is a nice infographic from the Boston Consulting Group

The picture above is the perfect segway into the industries that are at the core of this transformation. Now we need to research these industries and sectors and find the companies to invest. We can either do the legwork ourselves or start with what has already been built for us in the form of ETF’s. A quick google search returns a Horizon ETF ticker FOUR.TO. The simplest approach would be to invest in this ETF or if you are after more return, get a list of ETF holdings and pick the best plays based on fundamental and technical analysis. I take it one step further. I take the ETF holding and other companies from my research and I break them down into sectors and industries like below for FOUR.TO Holdings.

I do this for every trend creating a watch-list of companies in each industry that are participating in the long term secular growth markets. Instead of jumping into a trend, I use the tailwind of sector strength to maximize the returns. When you do the same exercise with every major trend, you start seeing patterns of companies that are involved in multiple trends. If the corresponding sector is also strong, now you have more reasons to get into the company. This is not a one time exercise. I am constantly researching these trends and adding to my database of companies, pivoting that by sector and updating the technicals and fundamentals. I run my scans against this list and I get into a trade when it satisfies my criteria.

How does it work in practice? I tested this with Next Generation Banking & 5G 2021, it worked very well. I picked up SI, COF, FISV, QCOM, MRVL when they sold off and came to a support. I was able to ride it back up for a nice return. Now these stocks would have been good picks just on technicals, but having the additional conviction of a market trend let me take bigger risks using leaps rather commons doubling my money in that period. This one worked out flawlessly. Even under less than ideal market conditions, I am betting that this approach has better risk-reward than just stock-picking on trend or technical signals alone. My list is constantly evolving after each quarter results. I cut ones that missed or guided down and I add new ones that have exceeded expectations. The idea fits in squarely with my investment methodology.

This analysis is far from complete. I will contine to research each company in the list and see how they stand within the sector, and what their biggest growth areas are. It will also help with the understanding and validation of the larger trend if the company data supports it.

In the next post, I will dive into Healthcare Technology and Next Generation Banking.

In the meantime, I am very excited to collaborate with ArchnaTrades to bring you actionable trading ideas. While my approach is to find long plays and swings, Archna is more tuned into the shorter term trades especially using derivatives. We hope this joint effort will cover a wider array of interest and risk profiles.

Please share your comments so I can improve my writing and my analysis.