Bear Market rallies can be vicious. Getting caught on the wrong side can wipe out an account in a handful of session. Extreme caution is advised over the next few days.

We are almost through the earnings season and going into a couple of weeks of light economic data. Just lack of bad news could keep this relief rally going longer than most are expecting but the pace of rally should slow down in that time

With that out of the way, this how I see the set up here:

Rate expectations are starting to line up with FOMC statements for the June and July meeting. That takes Fed Funds Rate 175-200 bps and a pause in September to see how impact plays out.

Inflation is showing signs of topping but far from turning down. June and July releases will be critical to market and to Fed direction. An actual pullback will give Fed time to pause and assess going into October meeting and potentially go on the sideline. Food and Energy markets are still undersupplied and they hold the most risk to bringing inflation down.

China easing is essential to fixing the supply side of the issue. This is still the real culprit in the whole mess we are in. Fed can help curtail demand and slow down the economy but at a cost. It is a lot cheaper to resolve the supply chain issue but it takes longer to filter through. Any normalization of supply chain can justify Fed adopting a slower wait and see approach.

June GDP data is critical to the market psyche. Are we already in a recession? Are we getting deeper into it? Or was the last GDP data a technical outlier and we edge back to expansion albeit at a slower pace. This will be important to consumer confidence going forward

There is also increasing reports on job cuts especially in Technology. This is very important to watch. Did we go directly from worker shortage to cutbacks in a compressed time? May be one more thing that will give Fed a pause.

Most of these thoughts are at best neutral rather than bullish. So where do we find opportunities? While the indexes are important directional indicators, the action is at an industry / sub-sector level. Over the next few weekly posts, I will explore industry by industry where the risk-reward is still positive.

For this week we are going to stop here and look at some trade setups that we like:

SI: Silvergate Capital announced blow out results and upped their guidance. Yet the crypto selloff has taken a hatchet to the multiple. We think this gets interesting here.

We are looking to sell Jun 17 $40 Puts for $165. We dont see the stock getting to 40. We are comfortable buying it there should we need to exercise it.

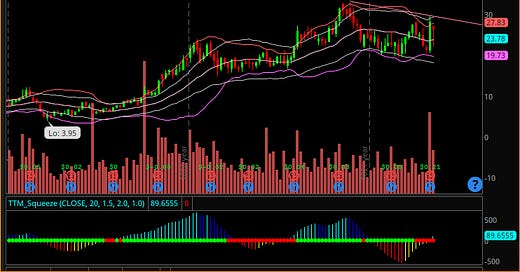

LTHM: Beat earnings, Weekly TTM squeeze setting up. Weekly hammer

Jun 17th expiration, 35C has over 14K contracts in Open Interest. So a possible trade I am looking at is 30/35 Call spread currently priced at .75 mid

Friday we had growth names run. Currently, this weekend Bitcoin has remained green and that bodes well for Risk On trades for Monday as of now.

SE as shown on my chart has a weekly hammer, which technically is a reversal. Se has earnings 5/17 before market as per Earnings Whisper. Its expected move based on options is $16. Last week it had a range of $21.94

So based on expected move we can get 92 by Friday. Based on last weekly range we could se $98 in SE.

If SE with its wide variety of businesses beats earnings and we are still in a market where growth bounces then getting to 100 price and maybe even a pin at 100 for this weekly May 20th expiration is possible.

2 trade ideas that we at Monetive are planning to take :

95/100 Call spread for Friday expiration is currently priced at .5

For a 100 pin, a call butterfly can be done 95/100/105 for May 20th expiration for .15 debit