Defense Industry in the current Geo-Political context

Active conflicts and increased posturing in multiple theatres and a raging cyber war are catalysts to put a spotlight on this sector. This is my own look at opportunities in Defense & Aerospace sector

At the outset, I am an opponent of this terrible war. The human and environmental consequences are horrible and leave a lasting destruction that will take decades to fix. Given we are here, this will be 4 part article looking at the defense industry in the current reality. It is my read on where the money is going in the Industry.

Any talk of Defense industry immediately shifts to the big players: LMT, NOC, RTX, BA. While these companies are obvious beneficiaries and largest recipient of spending, they also suffer from long and politically charged sales cycles that are very difficult to project. This current conflict in Ukraine has renewed in the defense sector but where are the orders? Who in the sector is going to participate in the orders when they come? We look at sector through a time cycle lens, who gets revenue and when in a defense buildout.

Here are some articles on the industry and the current geo-political environment:

https://news.sky.com/story/ukraine-war-how-weapons-makers-are-profiting-from-the-conflict-12624574

Conflict and NATO expansion both require massive replenishment program starting with consumables (Shells, equipment maintenance).

More ground movement and air space management puts extreme load on equipment and require more frequent renewals and repairs.

The current conflict in Europe and the expansion of NATO will require repositioning of forces and massive expansion of capabilities.

There is an ongoing and escalating cyber war not only with Russia but also China, North Korea and Iran.

High tech/Electronic warfare, Unmanned systems that are expendable and lower the risk to more expensive equipment like aircraft

Finally the big pieces have to be put in place, new aircraft, naval vessels, satellite systems, Tanks, troop carriers, artillery pieces etc.

We will look at current conflict in Ukraine and the immediate and direct spend to replenish usage in Ukraine but also the capability build in NATO and Non-NATO Europe as they prepare for potential spread of Russian belligerence.

Ammunition is being used at incredible rates and need to be resupplied as long as the war drags on.

NATO supplies of what they have sent to Ukraine have to be replaced and expanded substantially to deal with new reality of defensive needs to protect Europe. Some of the equipment will be replenished with new orders. Some of it will be replaced with next generation equipment.

All said and done, there are only a small number of firms that are involved with the equipment in the field in Ukraine. Ukraine is spending $4b monthly and before the war, that was their annual defense budget. The allies have sent close to $10bn in equipment, supplies and ammunition.

Lockheed Martin (HIMARS, M270, Brimstone )

EADS/Airbus (M270)

BAE ( Brimstone, Stormer HVM for Starstreak, Milan Anti Tank, M113 APC, AT4’s, M777, M109 Howitzers, 155mm Shells)

Thales (Bushmaster APC, Starstreak, NLAW Anti-Tank Missile, Javelin Anti-Tank, 155mm Shells)

Boeing (Harpoon Anti-Ship)

Raytheon (Stinger)

Leonardo (Brimstone)

AeroVironment (PUMA UAV, Switchblade Drone)

Kongsberg + (NAMMO/Patria) (155mm Shells, M72 LAW)

Rheinmetall (155mm Shells)

Olin/Winchester (M2 0.5BMG Ammunition)

(I am certain to have missed many items and there are many private unlisted companies not in the list above. Please verify all this information for yourself.)

This is a list that is changing almost on a daily basis as more information becomes available and more equipment is sent to the front. I do not any information on what if any new orders have been received by any of the companies. I only have enough information for my own needs to take positions. I will be doing additional research before increasing position size.

I have taken trading position on July 5th in Thales, BAE, Kongsberg, Rheinmetall.

I am not recommending any one of these stocks. I am only sharing my research and ideas. You should always consult an RIA and do your own due diligence before risking your capital.

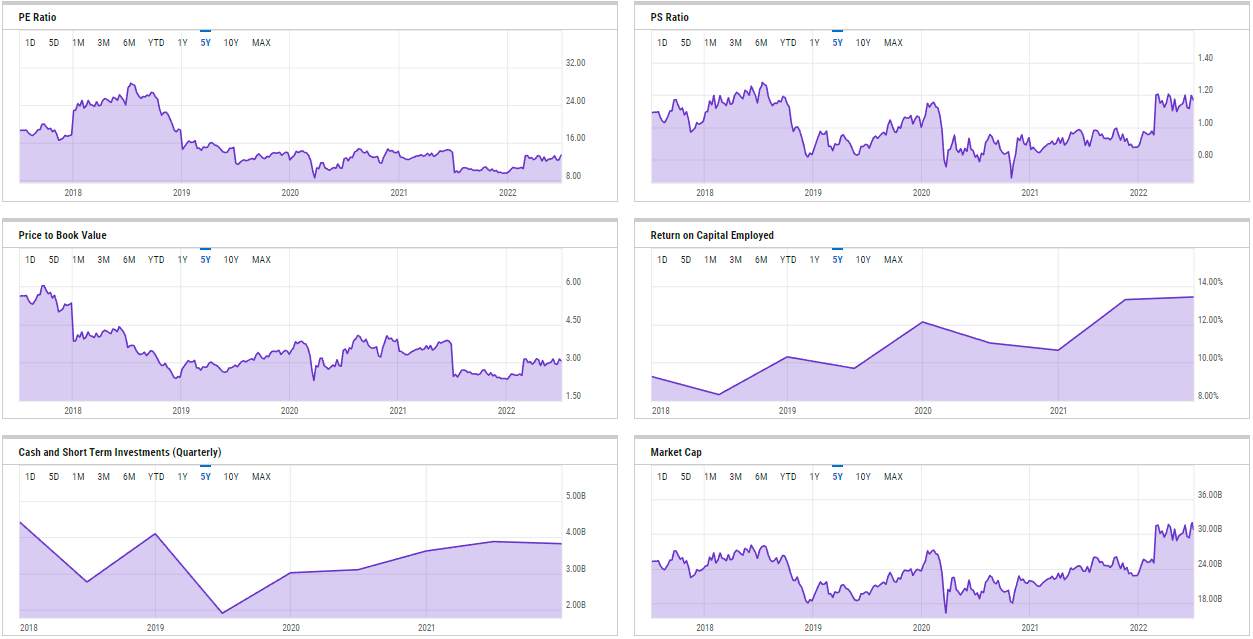

BAE Systems is a British global defense company. BAE has a dominant position in the U.K., is a top-six supplier to the U.S. Department of Defense, and has a strong presence in key defense markets (eg. Saudi Arabia and Australia). Exposure to programs is well diversified. BAE derives 45% of sales from services and support and 35% from major programs such as the F-35 Lightning II and Eurofighter Typhoon fighter jets. The balance of sales is derived from electronic systems and cyber intelligence.

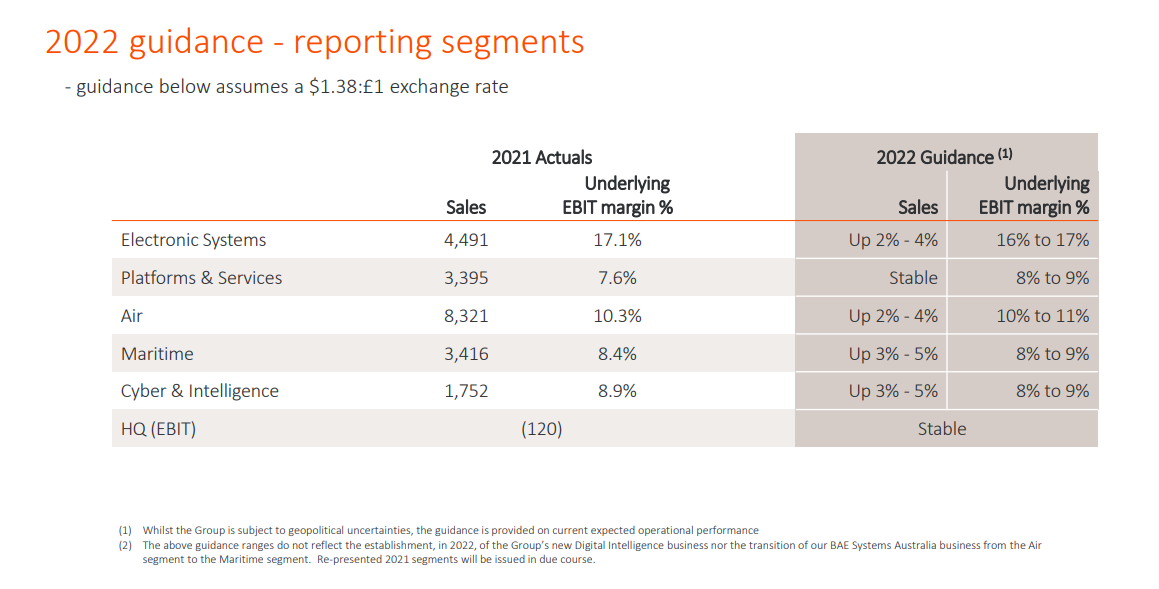

FY 2021: Divisional performance appears strong in the face of some US headwinds. Growth at constant currency was +5% in Electronic Systems, +3% in US Platforms & Services, +6% in Air, +5% in Maritime and +2% in Cyber and Intelligence. Electronic Systems revenue was impacted by Q4 supply chain issues and the effects of the ongoing Continuing Resolution. We understand a degree of conservatism on these factors is baked into 2022 guidance. Strength in ES margins was driven by recent acquisitions as well as operating performance, and the new margin target of 16-17% for ES is very reassuring. The main offset was slightly softer Air margins, which at 10.3% is towards the lower end of the 10-12% guided range.

Deutsche Bank has upgraded BAE in the wake of Ukraine War “The war has resuscitated the need for military platforms that encompass high technology components, such as tanks, fighter jets, submarines and surface vessels, said the broker.”

In a trading update, the firm said it expecting to post a 4-6 per cent boost in underlying profits for the full year, up from £2.2bn in 2021

https://www.cityam.com/bae-braced-for-demand-boost-in-wake-of-war-in-ukraine/

https://www.mbda-systems.com/press-releases/pgz-mbda-uk-agreement-for-tank-destroyers/

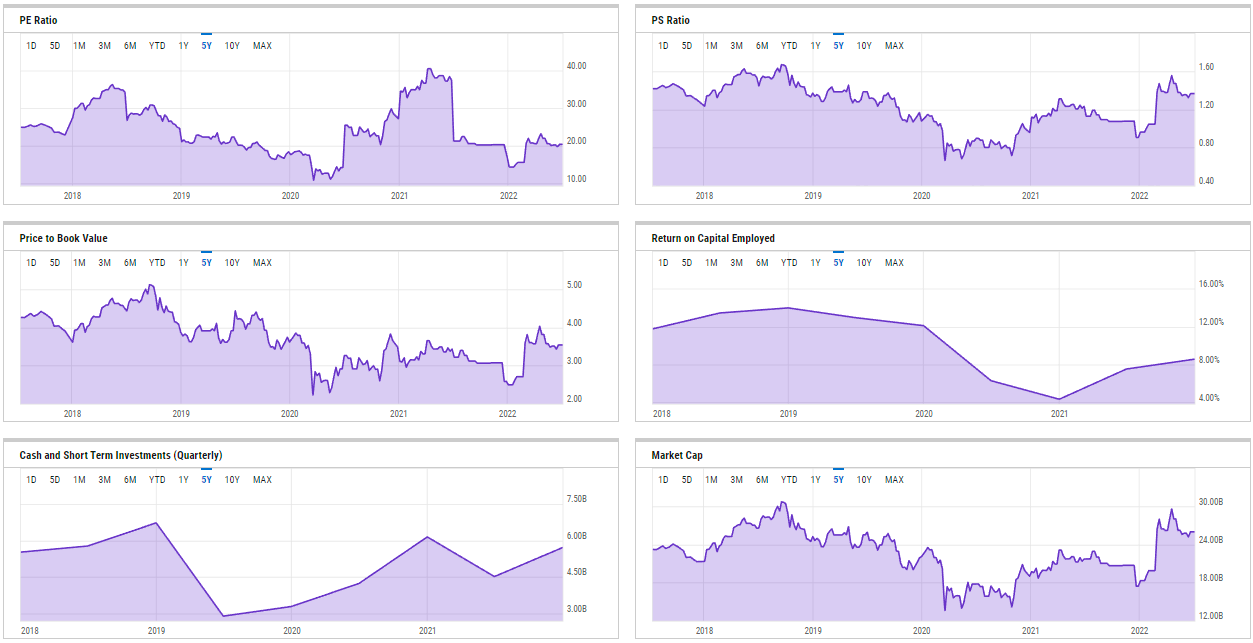

Thales is a French aerospace and defense industrial firm and is one of Europe's largest defense contractors with EUR 18 billion in sales. The company has four reportable segments: defense and security provides sensors, mission systems, communications and control systems to European and export defense customers; aerospace sells avionics and satellites to the civil, defense and government markets; transport provides signaling services to rail operators; and digital identity and security provides biometric, data, and identity security solutions

Thales concluded 2021 with an excellent fourth quarter in terms of order intake and operating free cash flow. Commercially, the Group achieved the best year in its history. These successes with our clients, combined with the remarkable mobilization of our teams, have resulted in cash generation of well over 2 billion euros. Considering this performance in 2021 and the outlook for 2022 and 2023, we are revising our cash generation target strongly upwards: the Group should thus generate nearly 5.5 billion euros of free operating cash flow over the 2021-2023 period. Organic growth returned above 5%. The EBIT margin was above 10%, benefiting in particular from a solid margin increase in Digital Identity & Security, which was more than 4 points higher than in 2018, the year prior to its integration into the Group.

Order intake: €19.9 billion, up 18% (+18% on an organic basis)

Sales: €16.2 billion, up 5.3% (+5.3% on an organic basis)

EBIT: €1,649 million, up 32.1% (+31.9% on an organic basis)

Adjusted net income, Group share: €1,361 million, up 45%

Consolidated net income, Group share: €1,089 million, up 125%

Free operating cash flow €2,515 million, 185% of adjusted net income, Group share

Dividend of €2.56, up 45%

2022 objectives:

Book-to-bill above 1, supporting sales growth acceleration in 2023

Sales between €16.6 and €17.2 billion, corresponding to organic growth between +2% and +6%

EBIT margin between 10.8% and 11.1%

2019-2023 cash flow generation target revised upwards:

Conversion ratio of adjusted net income to free operating cash flow: 115%

Around €5.5 billion of free operating cash flow expected for 2021-2023

https://seekingalpha.com/article/4498792-with-war-in-ukraine-thaless-defense-unit-could-surprise

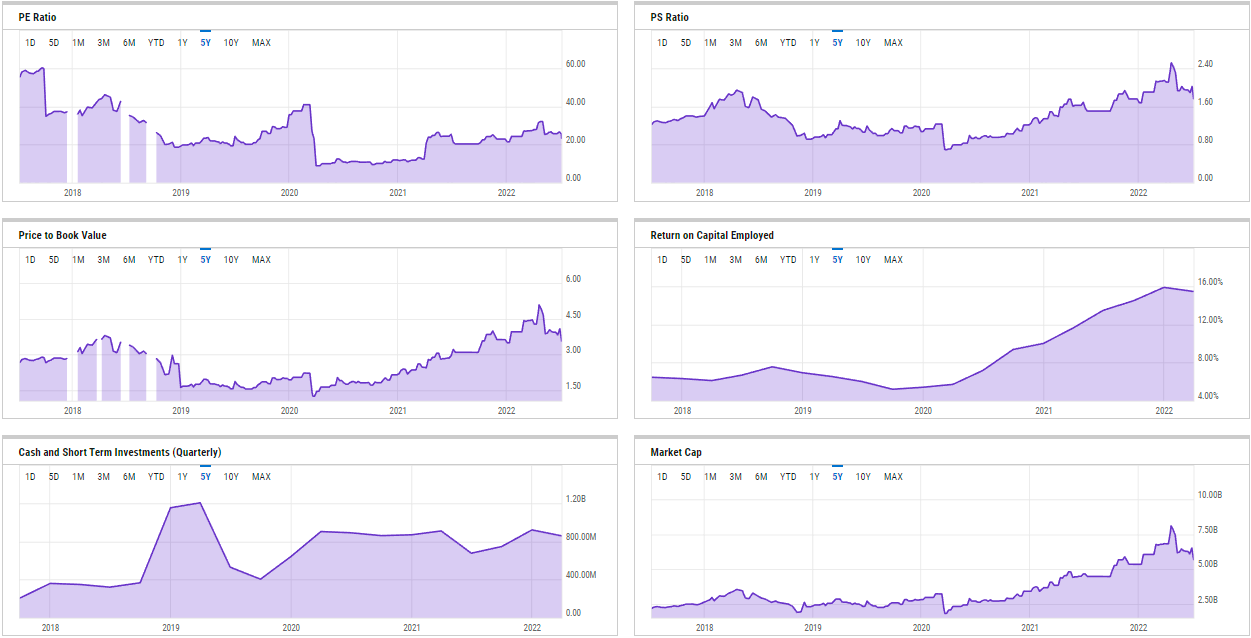

Kongsberg Gruppen ASA is an international technology company that supplies products and services to defense, maritime, oil, gas, and aerospace industries. The company is divided into two business segments: the maritime segment and defense and aerospace systems. Maritime, which earns most of the company revenue, creates navigation, automation, monitoring, and positioning products for commercial ships and offshore industries. The defense and aerospace segment provides defense and space-related products and systems. Outside of the two main segments, the firm operates Kongsberg Digital, which produces digital solutions for oil, gas, wind, and merchant marine markets. Products are delivered globally with North America accounting for about a third of total revenue.

Kongsberg Increased operating revenues and solid order intake with a book-to-bill ratio of 1.06 and an EBITDA margin of 11.8 per cent in Q1 gives a good start to 2022. Delays due to lack of components have a negative effect on revenue recognition in KDA. EBITDA is affected by MNOK 113 related to extraordinary appreciation for employee and MNOK 69 related to loss provisions related to the sanctions. Adjusted for this, the Group had increased its EBITDA and margin compared with Q1 last year. MNOK Q1 Operating revenues: 7,046 EBITDA: 829 EBITDA margin: 11.8% .KONGSBERG’s order backlog increased by NOK 0.4 billion in the first quarter of 2022 and is now NOK 49.9 billion. Of the total order backlog, NOK 17.3 billion will be delivered during 2022. This gives an order coverage that is NOK 2.7 billion higher than it was at the end of the first quarter of 2021. Order intake from the aftermarket is to a lesser extent included in the order backlog. The order backlog in associated companies, as well as framework agreements are in addition to the reported order backlog. The basis for further growth in 2022 is good.

Kongsberg Defense: 5 percent growth in operating revenues from Q1 2021 and 18.6 percent EBITDA margin. Lack of certain components has caused delays in deliveries of weapon stations that affect revenue recognition and EBITDA. MNOK 37 of costs related to an extraordinary appreciation to employees. A solid order backlog of close to NOK 35 billion will ensure growth also in 2022. MNOK Q1 Operating revenues: 2,472 EBITDA: 460 EBITDA margin: 18.6% . KDA has grown continuously for the last four years, and since the end of 2017 increased its order backlog by 350 percent to NOK 34.5 billion. Of this, NOK 8.7 billion is for delivery for the rest of 2022. The growth rate from previous year is thus within reach also for 2022. However, the challenging situation regarding the availability and logistics of some components means that we may experience fluctuations in operating revenues. The project mix driving this is an important driver in the profitability of the business area. The projects that will contribute most to operating revenues in 2022 will largely be the same as in 2021 and profitability is therefore expected to remain at a good level.

Kongsberg also has significant defense presence through 50% ownership of NAMMO and Patria

https://www.nammo.com/about-us/finance/

https://www.patriagroup.com/about-us/financials

The financials of these 2 companies are not consolidated with Kongsberg.

https://www.patriagroup.com/newsroom/patria-magazine/tech/finland-and-patria-support-latvian-defence

https://www.thedefensepost.com/2018/01/17/kongsberg-patria-missile-systems-agreement/

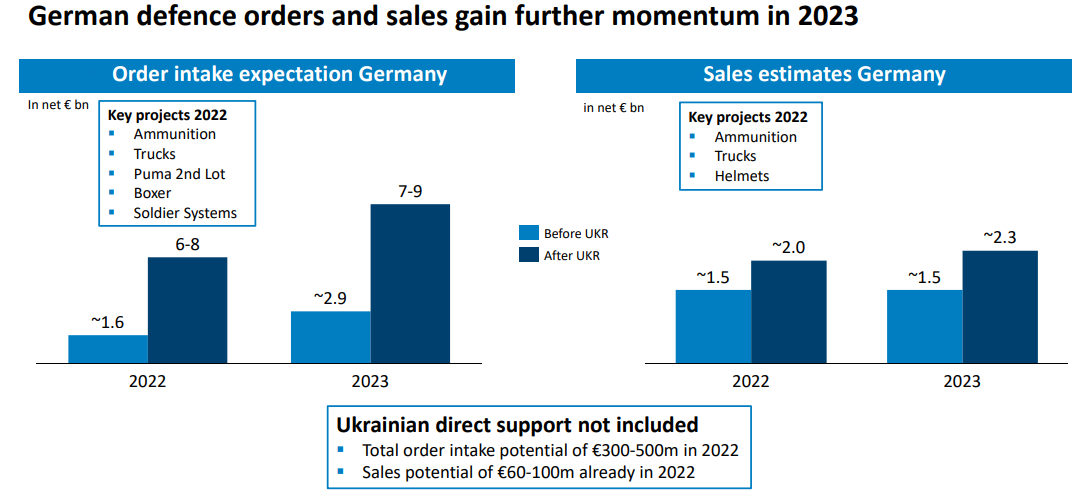

Rheinmetall AG is an international technology firm specializing in security and mobility. It is a leading European systems supplier for armed forces technology and a reliable partner to the armed forces of Germany, NATO, and friendly nations. The company has two operating segments: defense and automotive. It supplies armored vehicles, protection and weapons systems, sensors, and fire control systems. The automotive segment supplies engine systems, pistons and bearings, and other components under multiple brands. In addition, Rheinmetall utilizes various distribution channels to establish a healthy aftermarket revenue stream. Europe accounts for approximately half of total revenue, but the company does distribute solutions to North America, Asia, and other regions

Rheinmetall boosts profitability in the first quarter: Operating result and margin improved further

Consolidated sales of €1,266 million on a par with the previous year

Consolidated operating result increases from €84 million to €92 million – growth of 10%

Further improvement in operating margin – 7.3% after 6.7% in the same quarter of the previous year

Continued high growth in orders

Annual forecast for 2022 confirmed

Rheinmetall AG further strengthened its profitability in the first quarter of 2022 while maintaining stable business performance. As a result, the technology group is on course to achieve its ambitious profitability target for fiscal 2022 and further boost income.

The Rheinmetall Group confirmed its annual forecast from March 2022 and is anticipating growth in sales in conjunction with a higher operating margin and, in turn, a further improved operating result in fiscal 2022.

https://www.swissinfo.ch/eng/ukraine-war-a-windfall-for-swiss-arms-industry/47581582

The second article in the series will look at the escalating Cyber War and the companies that are supporting the governments in this arena.

In the meanwhile, please follow us on twitter @MonetiveWealth and @Archna2011. We post our trades, updates and portfolios on Twitter and Substack.