Defense & Cyber Security

Cyber Offense and Defense is at the forefront of the new cold war and is increasingly a bigger part of defense and security planning for nations and alliances like NATO.

Defense Industry caught a wave in Q1 as the war in Ukraine started. We got in early Q1 even before the Russia troops crossed into Ukraine. We go out in May and the stocks continued to run up another 15% before they sold off in June. We identified beginnings of another rotation in late June. We were hesitant to go in fully until we saw the Q2 earnings. We have positions in the the ETF DFEN and LMT, RTX, BA, LDOS and LHX. The recent orders and the data from the June Durable Goods is further confirmation of the strong order cycle in Defense and supports our rotation thesis. This article is not about the big players. It is a look at companies in the Defense and Federal Cybersecurity space

There are 2 primary Cyber Security Agencies in the US Government:

CISA leads the Nation’s strategic and unified work to strengthen the security, resilience, and workforce of the cyber ecosystem to protect critical services and American way of life. CISA works with each federal civilian department and agency to promote the adoption of common policies and best practices that are risk-based and able to effectively respond to the pace of ever-changing threats.

DCIO CS oversees the Defense Department's cybersecurity policies and programs to preserve U.S. Military advantage and defend U.S. interests. The office oversees the integration of Defense-wide programs to protect the Department's critical infrastructure against advanced persistent threats, and assures coordination of cybersecurity standards, policies, and procedures with other federal agencies, coalition partners, and industry. The DCIO CS priority is to support the Department's Cyber Strategy and DoD CIO's Vision to deliver an information dominant domain to defeat our Nation's adversaries. Policies and programs are designed to:

Ensure the Joint Force can achieve its missions in a contested cyberspace environment

Strengthen the Joint Force ability to conduct cyberspace operations that enhance U.S. military advantages

Supports the defense of U.S. critical infrastructure from malicious cyber activity that alone, or as part of a campaign, could cause a significant cyber incident

Secure DoD information and systems against malicious cyber activity, including DoD information on non-DoD-owned networks

Expand DoD cyber cooperation with interagency, industry, and international partners

These 2 agencies respond to threats from private individuals, criminal organizations as well as state actors like Russia, China, Iran and North Korea. With a combined annual budget exceeding $21 billion they are a very significant buyer of cyber security solutions. The difficulty in analyzing this from an investment perspective is the lack of pure play companies in the space. For the purpose of this analysis I am going to divide the space into 3 broad categories:

Purpose built security hardware and software solution for DoD. They include both Cyber Warfare and Cyber Defense solutions from the Defense Suppliers like LMT, Raytheon, L3 Harris, Leidos, General Dynamics, Airbus, BAE, Thales,

Cyber Security solutions primarily aimed at cyber defense and protection: These are solutions from the Security industry like Perimeter Defense, Access Control, Zero Trust. Active Monitoring & Defense, The biggest players are Cisco, Fortinet, ZScalar, Palo Alto, Checkpoint, Mandiant.

Solution Integrators and solution providers that design, customize, implement and execute security solutions for the 2 agencies. These are companies like SAIC, Mantech, CACI, Booze Allen, DXC Systems, IBM, Microsoft, Amazon, Google

The proportion of government contracts to non government business is rather small for most cyber security companies so moving the needle on valuation even with large government orders is difficult.

The last article in this series will look into the large defense contractors. Cyber security is covered in detail in many places and by sell side analysts. In this article we will look at companies not commonly discussed that are primary solution integrators for Federal agencies. These companies has substantial Federal business with long term contracts that helps them weather business cycles better than the overall market.

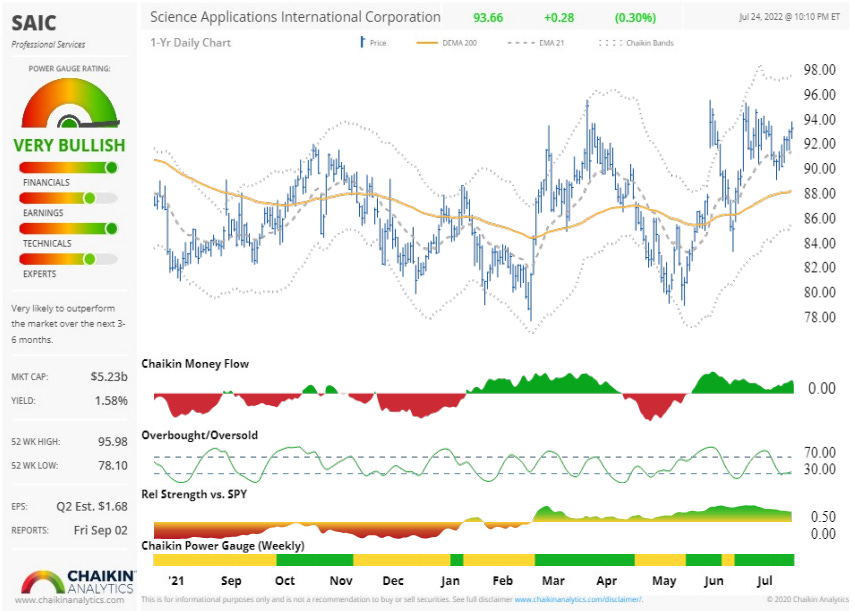

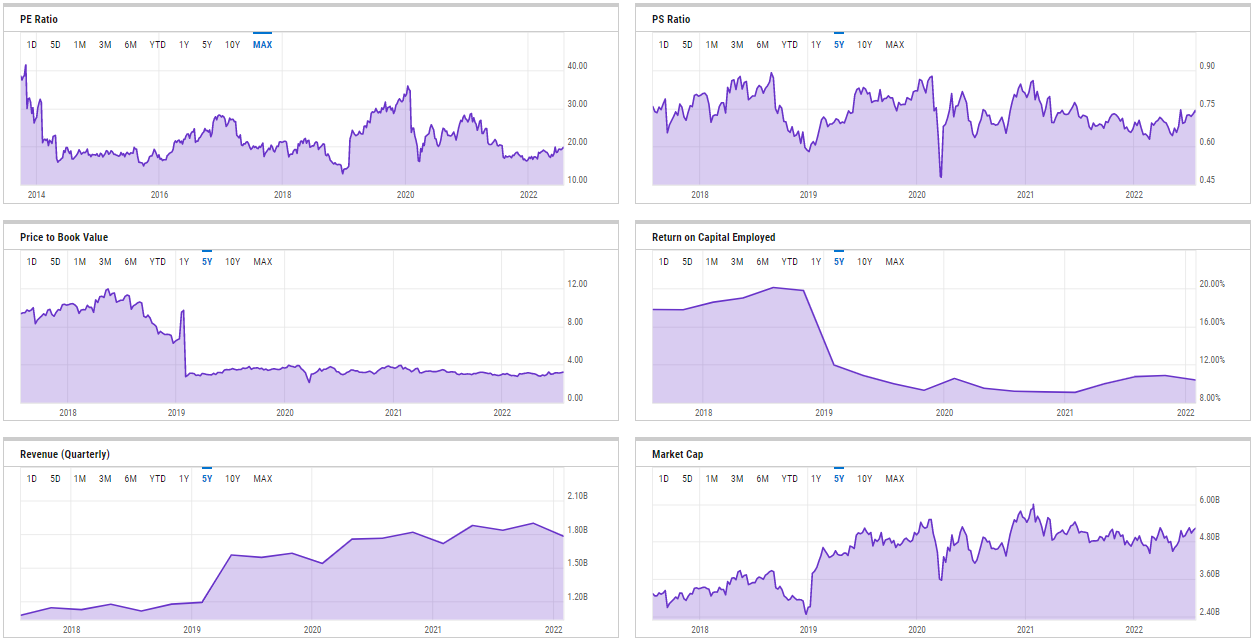

Science Applications International Corp (SAIC) provides technical, engineering and enterprise IT services primarily to the U.S. government. Specifically, the company offers engineering, systems integration and information technology for large government projects and a broad range of services with an emphasis on higher-end technology services. The company's end-to-end enterprise IT offerings span the entire spectrum of customers' IT infrastructure.

It is one of the Department of Homeland Security’s prime defense contractors. It received the Eagle II contract to provide information technology solutions to the department and other agencies supporting its mission.

SAICS also teams up with small businesses to support the DHS’s needs. Further, SAIC, a Reston-based Fortune 500 defense contractor, received an award from the General Services Administration worth $878 million to provide research and development, cybersecurity, technology, and engineering services. This includes deploying capabilities to help warfighters gather critical data and information efficiently and maintain advantages in decision-making.

Lastly, the company announced it would work with the Department of Defense to provide cyber security training for its personnel under the Defense Information Systems Agency’s (DISA) ENCORE II contract worth over$90 million. It will run for a year with four one-year options.

SAIC has performed very well in a declining market and analysts expect the company to continue to outperform.

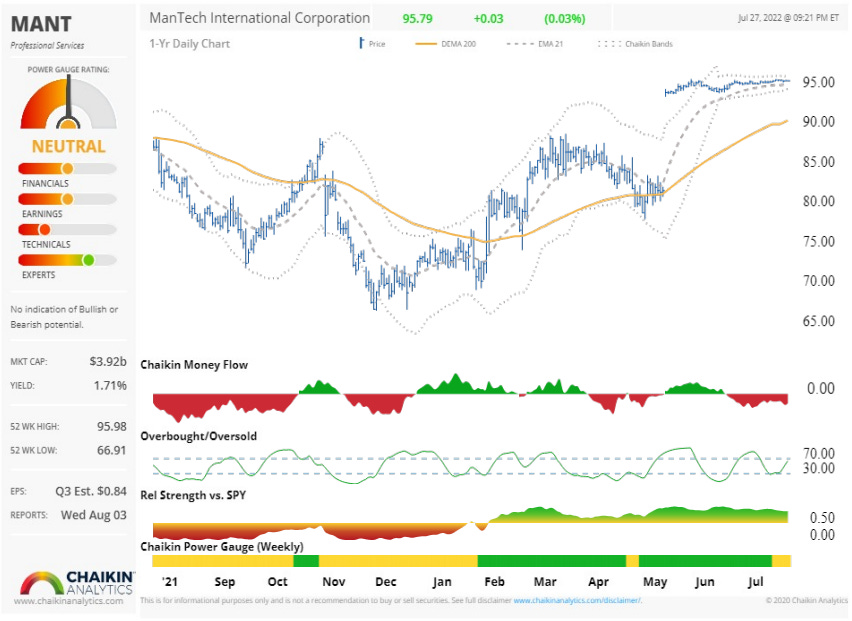

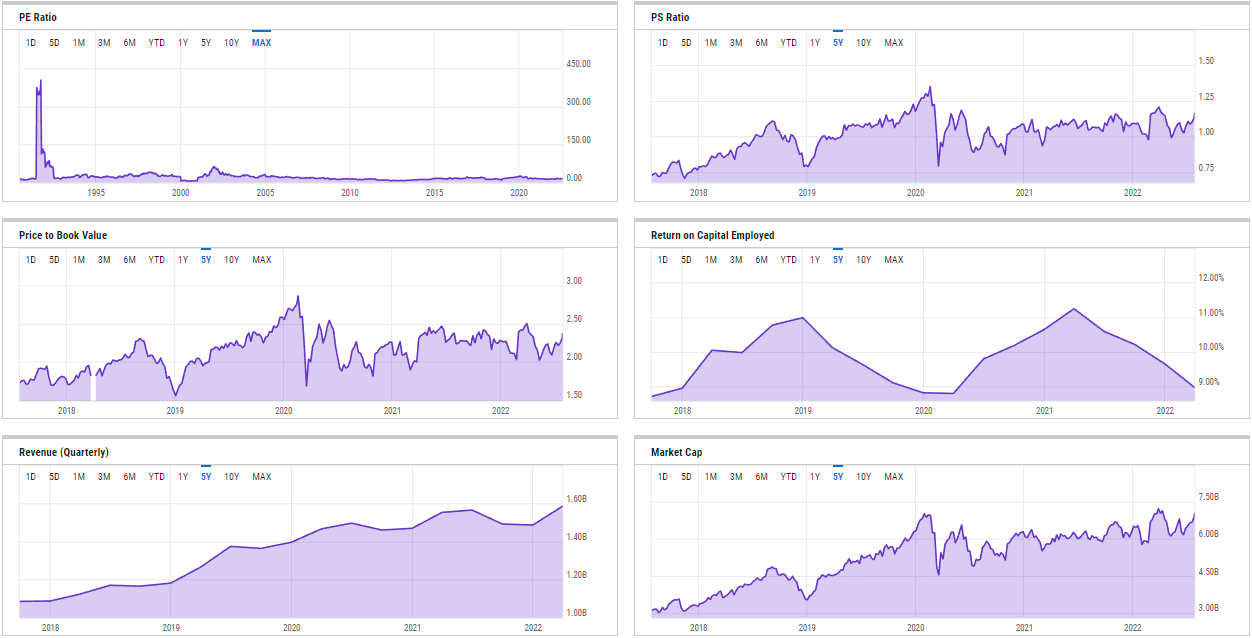

Mantech International Corp (SAIC) provides mission-focused technology solutions and services for U.S. defense, the intelligence community, and federal civilian agencies. The company provides full-spectrum cyber, encompassing defense, resilience, offense, analytics, and compliance. It offers professional and technical solutions, and support services; command-and-control infrastructure, intelligence, surveillance and reconnaissance platforms and sensors, and data services; and vulnerability assessment, insider threat protection, exposure analysis, secrecy architecture design, security policy development and implementation, lifecycle acquisition program security, anti-tamper, export compliance support, foreign disclosure, system security engineering, security awareness and training.

ManTech is the leader in deep research of offensive cyber that helps US carry out Defend Forward. They support Defense customers’ Cyber Network Operations (CNO) activities, providing detailed understanding of adversary organizations, capabilities and infrastructure and even attribution of the offender – empowering nation to strike first.

ManTech’s ACRE is a unique physical and virtualized cyber range that brings best-in-class cyber defense expertise to a new generation of professionals. Existing system and network infrastructures can be replicated on ACRE, and then activated with realistic collaborative solutions for traffic, users, and malware including compliance and log retention, security information and event management, security operations center supplementation or replacement, risk reduction, insider threat, information assurance, cyber range customization and hands-on cyber training.

ManTech’s advanced analytics provide vital intelligence on the source and nature of cyberattacks, and can even stop them in the planning stage.

#1. Cyber specialists in the U.S. Department of Defense, the U.S. Marine Corps, the National Guard Bureau, and many other military and national security institutions have sharpened their skills and learned new techniques in Mantech facility. They are actively training the next generation of federal cybersecurity experts.

The stability and strength of Federal business is the biggest reason that MANT is still trading near all time high. The company has consensus rating of HOLD and is currently selling near its PT. This is good add on any significant pullback.

Booze Allen Hamilton (BAH): Booz Allen Hamilton Holding Corp is a provider of management consulting services to the U.S. government. Other services offered include technology, such as cloud computing and cybersecurity consulting, and engineering consulting. The consulting services are focused on defense, intelligence, and civil markets. In addition to the U.S. government, Booz Allen Hamilton provides its management and technology consulting services to large corporations, institutions, and nonprofit organizations. The company assists clients in long-term engagements around the globe.

Winning on the complex future battlefield requires technology solutions that create information dominance. As the premier digital integrator for the Department of Defense (DOD), Booz Allen delivers by blending decades of mission experience with state-of-the-art artificial intelligence/machine learning (AI/ML), next-generation data solutions, networking, cyber, and advanced software development.

BAH helps law enforcement agencies develop and deploy specialized technical investigative tools and technologies. Our homeland security and law enforcement teams work to address some of the most difficult issues facing government leaders. They provide a professional workforce that includes security information technology and engineering specialists, experts in intelligence analysis and training, business transformation professionals, and seasoned law enforcement practitioners. BAH expertise draws from the senior ranks of the law enforcement and counterterrorism communities, with both domestic and international experience.

Military and intelligence leaders have relied on Booze Allen to support critical intel missions from the World War II era and the days of Sputnik through the evolution of cyber attacks and today’s ever-changing threats. BAH long-term support of clients across the intelligence community, the Department of Defense, and civil government reflects our success in areas like cybersecurity, analytics, digital transformation, and space defense.

In June 2022, Booz Allen Hamilton has won a potential $99 million contract to support infrastructure and cybersecurity operations of two U.S. Navy organizations responsible for the service branch’s information warfare force generation and oceanography program

In March 2022, NASA Awarded Booz Allen a Cyber Contract Worth Up to $622.5 Million. This is the First-Ever NASA Cybersecurity and Privacy Enterprise Solutions and Services (CyPrESS) Contract

In 2018, The US Department of Homeland Security (DHS) handed over a $1 billion contract to Booz Allen Hamilton to boost cybersecurity across six federal agencies. With this deal -- Booz Allen's second-largest cybersecurity task order ever -- the contractor is now responsible for securing nearly 80 percent of the .gov enterprise.

Booz Allen announced in March that it plans to acquire EverWatch, a Reston-based government solutions contractor. The deal will allow Booz Allen to speed delivery of classified software development and analytics capabilities for national security clients and complements its artificial intelligence and cyber portfolio.

In 2021, Booz Allen bought Herndon, Virginia-based health information technology consulting firm Liberty IT Solutions for approximately $725 million in June and then moved to acquire the remaining stake in cybersecurity company Tracepoint in September.

Analysts have an outperform rating on BAH. The stock is trading at or near ATH.

CACI International (CACI) is an information solutions and services provider, offering a variety of information solutions and services to its customers. The company's primary customers are agencies and departments of the U.S. government, which account for the vast majority of the firm's revenue. It provides information solutions and services supporting national security missions and government modernization/transformation for intelligence, defense, and federal civilian customers. The firm conducts its operations through a variety of subsidiaries in the United States and Europe.

CACI transforms how government does business: Using Agile-at-scale methodologies and deep customer understanding, CACI will modernize applications, infrastructure, and business processes to enhance performance and increase end-user satisfaction. They use advanced data analytics and visualization tools to modernize access to data, enhance productivity, and translate data into decisions.

CACI provides technology that enables C4ISR superiority for air, ground, sea, space, and cyber domains. Software defined electronic warfare (EW), signals intelligence (SIGINT), and counter-unmanned aircraft technologies (C-UAS) provide protection and deliver precision effects against any adversary. They deliver groundbreaking space technology – from laser communications and advanced launch operations to exploitations in the space domain. CACI's innovations in cybersecurity address today’s and tomorrow’s challenges and overlay across EW, SIGINT, C-UAS, and resilient communications technologies.

Engineering Services: CACI optimizes and integrates technologies to deliver a decisive tactical edge.They enhance platforms to improve situational awareness, mobility, interoperability, lethality, and survivability; conduct software vulnerability analysis and harden technology to protect against malicious actors. CACI platform-agnostic, mission-first approach ensures optimal performance, so our nation’s forces can overmatch our adversaries.

CACI announced in June 2022 that it was awarded a $557.8 million single-award task order under the Department of Defense Information Analysis Center Multiple Award Contract (IAC MAC) vehicle to provide mission expertise for the transition of modern digital tools into the U.S. Navy acquisition enterprise for the Navy’s Digital Integration Support Cell (DISC) and Naval Surface Warfare Center (NSWC) Crane. CACI’s support includes analysis, development, and planning for the transition of programs of record into newly developed or updated technology systems. The team will leverage standards and practices necessary to integrate advanced capability into distributed maritime operations, supporting advanced mission kill chains in an integrated, interoperable environment.

CACI International Inc has been awarded a new task order worth approximately $80 million to provide mission expertise to the U.S. Army’s Intelligence and Security Command (INSCOM) and the 116th Military Intelligence Brigade (MIB) in support of the Army’s Solutions for Intelligence Analysis 3 (SIA-3) effort. Under the task order, CACI will offer tactical intelligence and analytical expertise to assist in the ever-changing landscape of the Army’s aerial intelligence, surveillance, and reconnaissance (ISR) missions.

CACI in May2022 won a $138 million single-award mission expertise task order to continue to provide Tactical Communications (TACCOM) engineering and maintenance support services to U.S. Immigration and Customs Enforcement (ICE). The TACCOM program provides critical voice communications capabilities for the ICE mission. Awarded under the TACCOM II indefinite delivery, indefinite quantity contract, this task order significantly expands both the scope and size of the company’s support to ICE.

In April 2022, CACI was awarded a task order worth $258 million to expand its enterprise technology support and continue modernization efforts to the Defense Agencies Initiative (DAI) program office’s financial management and end-to-end business processes. Awarded under the Defense Logistics Agency's (DLA) J6 Enterprise Technology Services (JETS) indefinite delivery, indefinite quantity (IDIQ) contract, the task order continues CACI’s current enterprise technology support to modernize Department of Defense (DoD) business systems, ensuring DoD agencies participating in DAI meet evolving business, technology, security, and control requirements.

CACI has an outperform rating and a PT of 320-370

As always, these are trade ideas not investment advice. You should consult a registered investment advisor and do your own due diligence before investing.

In the next article on Defense Sector, we will look at Defense Logistics players and opportunities in expansion of NATO and larger deployments to counter Russia and China. The final article in the series will look at the Major Defense Equipment/ Aircraft suppliers.

If you like these posts, please subscribe.

You can also follow us on twitter @MonetiveWealth and @archna2011.