We have mentioned Datadog in our previous posts and we are still big fans of the company, We are dedicating this post to discussing the technical setup.

Datadog is a Cloud native data analysis, monitoring security solution provider. It has been named a Leader in the 2021 Gartner Magic Quadrant for Application Performance Monitoring. It has been a stellar performer quarter after quarter.

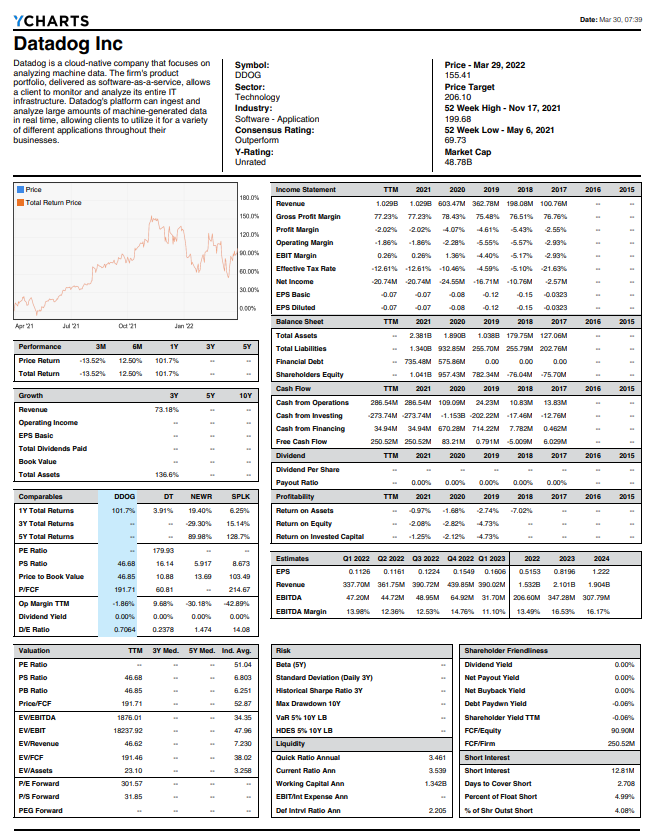

Fiscal Year 2021 Financial Highlights:

Revenue was $1.03 billion, an increase of 70% year-over-year.

GAAP operating loss was $19.2 million; GAAP operating margin was (2)%.

Non-GAAP operating income was $165.1 million; non-GAAP operating margin was 16%.

GAAP net loss per diluted share was $(0.07); non-GAAP net income per diluted share was $0.48.

Operating cash flow was $286.5 million, with free cash flow of $250.5 million.

Fourth Quarter & Recent Business Highlights:

As of December 31, 2021, we had 216 customers with ARR of $1 million or more, an increase of 114% from 101 as of December 31, 2020. As of December 31, 2021, had about 2,010 customers with ARR of $100,000 or more, an increase of 63% from 1,228 as of December 31, 2020.

Announced Federal Risk and Authorization Management Program (FedRAMP) Agency Authorization at the moderate impact level.

Announced the launch of Sensitive Data Scanner. helping customers comply with regulatory requirements (such as GDPR, HIPAA, CCPA), industry standards and business policies.

Announced a global strategic partnership with Amazon Web Services, Inc. (AWS). Achieved the AWS Graviton Ready designation, part of the Amazon Web Services (AWS) Service Ready Program. Achieved Amazon Web Services (AWS) Migration & Modernization Competency status for AWS Partners.

Announced integration with Confluent, the platform to set data in motion.

First Quarter and Fiscal Year 2022 Outlook:

First Quarter 2022 Outlook:

Revenue between $334 million and $339 million.

Non-GAAP operating income between $36 million and $41 million.

Non-GAAP net income per share between $0.10 and $0.12, assuming approximately 348 million weighted average diluted shares outstanding.

Fiscal Year 2022 Outlook:

Revenue between $1.51 billion and $1.53 billion.

Non-GAAP operating income between $160 million and $180 million.

Non-GAAP net income per share between $0.45 and $0.51, assuming approximately 350 million weighted average diluted shares outstanding.

Here is a summary of the financials:

DDOG should have a place in your portfolio and this analysis should help you find the appropriate entry and exit.

Share this post