Business Cycles and Sector Rotation

Using a time tested investment thesis to generate alpha in a difficult economy

The era of free money brought with it the gargantuan Technology bull run where growth overshadowed and outperformed anything else on offer. Zero Interest rates meant that fast moving tech companies could buy growth against a TAM that was calculated with rose colored glasses assuming a never ending fiscal and monetary support to the markets.

That scenario unraveled starting with the fed minutes in January and the successive and torrid pace of rate hikes and the QT targets becoming reality. Since this all began, we have seen rotation out of technology sector into to Energy, Industrials, Healthcare, Staples and Utilities. Some of those moves have sustained all year long while others have been less sticky. Given that the fed might go on the sidelines in a few months, it is a great time to look at the the idea of sector rotation and understand how it can create alpha.

Sector Rotation can be triggered by Economic/Business Cycles, Market Cycles or by Technical factors like overbought or oversold conditions.

The business cycle depicts the rise and fall in output (production of goods and services), over time.

The upswing of the business cycle towards a peak is called an economic expansion. An economic expansion is associated with: increase in production/output; decrease in unemployment; increase in wages; increase in consumer spending.

The downswing of the business cycle towards a trough is called an economic contraction. It is associated with: decrease in production/output; increase in unemployment; decrease in wages; decrease in consumer spending.

The business cycle can also go through more extreme phases. A boom is a period of strong economic expansion where many businesses are operating at full capacity or above capacity, and the unemployment rate is very low. Income and production are at very high levels. This can lead to rapid growth in prices. A recession is when output has fallen for a period of time and the unemployment rate increases. A depression is a very severe recession. There is a large contraction in the economy, and the unemployment rate is likely to be at a very high level.

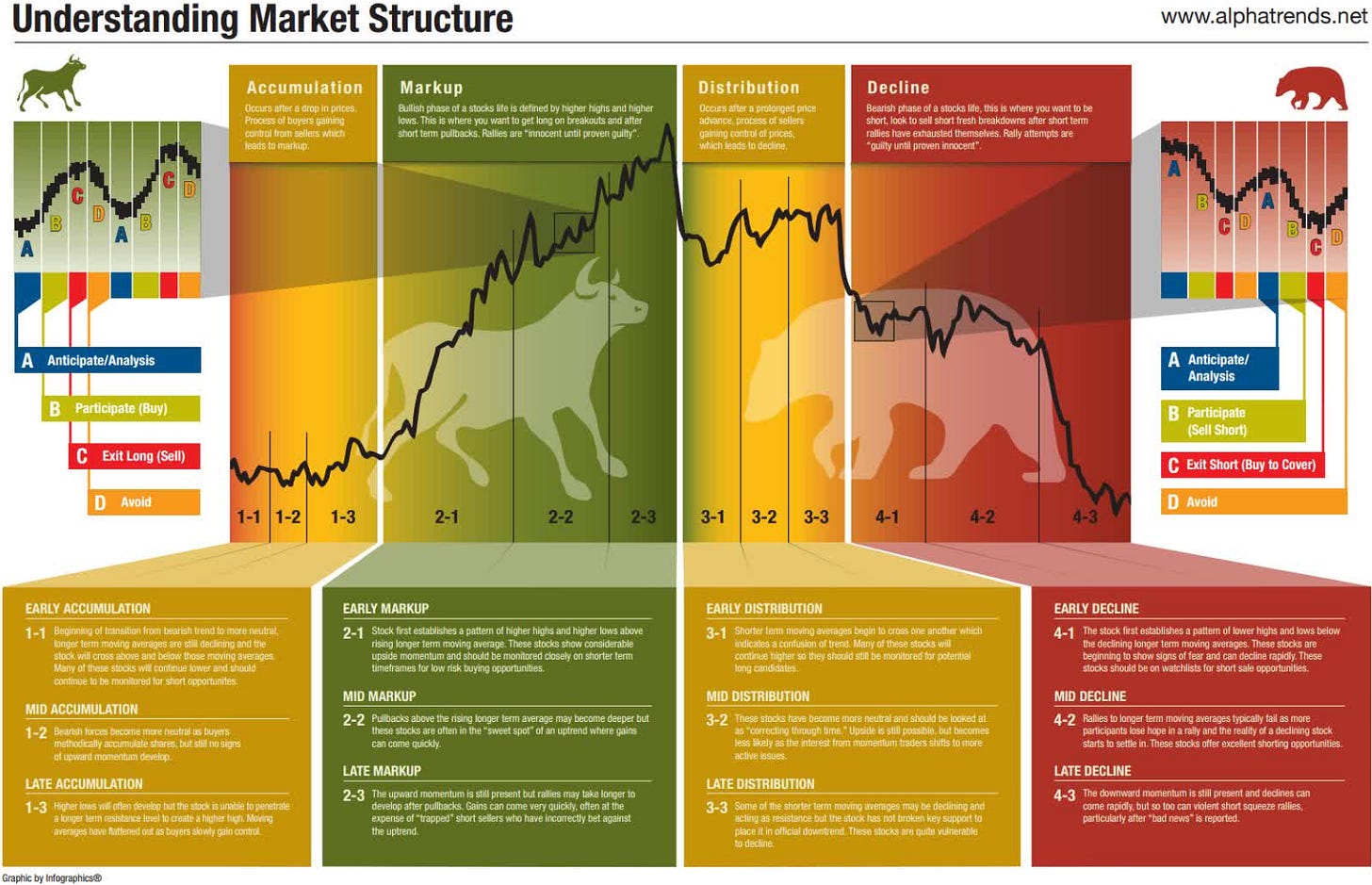

Market cycles refer to market patterns that form with shifts in the market or business environment. A market cycle is the process in which bull markets mature from beginning to end and then reverse into a bear market where excesses from the bull market are corrected. Some groups of stocks may outperform others during a market cycle if the cycle improves the stocks’ fundamentals, which is why it’s important for traders to identify the current cycle of the market.

Accumulation is when investors, thinking that the worst is over, that markets have “bottomed out” and that prospects for the economy look good, begin buying again. Essentially, prices are low and value is high.

Markup is the second wave of buying, when the market is more stable. This stage is easier to identify, with media and news outlets highlighting the upward trend and investors putting their money back into the markets.

Distribution is the phase at which prices are at their peak. The “Bull market” that was pushing prices higher slowly begins to level off, and a relatively equal amount of buying and selling is seen across the markets.

Decline/Downtrend, sometimes called the “markdown,” is the final stage – triggered by widespread selling, as investors try to lock in profits and avoid major financial losses. A prolonged downtrend phase becomes a “Bear market.”

Let's combine the Economic and Market cycles and look at how sector strength plays in different phases.

Sector Rotation idea has been around for a long time and there are various way to invest using sector rotation. At it simplest, overweight the sectors that outperform during the current phase of the business cycle and underweight the other sectors or even go short. There are various ways to build on this idea to optimize the returns and reduce the risks even further. At Monetive, we don't rotate at a sector level but rather go into the industry/subsector level to find what is working at any point in time.

Let's look at some data from the S&P500 sectors and a couple of subsectors (Industrials and IT) . The data shows performance MTD, QTD, YTD and 52 Weeks.

Industrials have returned a negative 7.8% in the last 52 Weeks. Aerospace & Defense during the same period produced 11.8% positive return.

Information Technology lost 17.5% in the last 52 Weeks and Semiconductors lost 21.8% during the same period. However in November, IT grew by 6.4% and Semis by 14.9%.

As you start looking at sector data over periods of time and break it down by industry you start to see outperformance on certain industries. This could be for a variety of reasons: Industry Macros, Geopolitics, or technical like Oversold bounces. At Monetive we believe first 2 explain the outperformance of Aerospace & Defense and the recent outperformance of Semis is a technical oversold bounce. We also strongly believe that strong Macro signals tend to outlast technical factors. We are likely to use technical signals to swing trade while we use macros for go long..

We track industry performance every week using multiple indicators technical, fundamental, macro, news etc. and we use a combination if these factors to identify signal change to enter. We typically do not bottom fish but rather wait for a trend to establish and strengthen over a few weeks and look for confirmation before building a large position. We also don't define a holding period but rather let the signals dictate how long we stay in the stock. As long as our investment thesis is valid, we stay in the position and we exit when that changes. We will start taking profits systematically once significant profits are made. We leave runners and tighten stops as the run gets overextended. We will also pare back when we get confirmation on a new rotation signal in another industry.

As the markets get further and further away from a loose monetary and fiscal policy, it will become more important to cast the net wider for market beating returns and we believe that sector rotation provides a time tested way to get there. There is a lot of well written papers on Sector rotation and we highly encourage readers to search them out to understand the process.

This is just a primer on what sector rotation is and how we approach it.

If you like our ideas and writing, please follow us on twitter @monetivewealth and @archna2011. You can also subscribe to Monetive Wealth Market Musings and Index Income Trades

We put out content for education purpose only. You should always do your own due diligence and consult a registered investment advisor before investing your money.

Good to see substack writeup after long time

Agreed!