A closer look at the LMT, RTX, GD

In this part 1 of 2 we look at the top 3 defense contractors.

This is a timely look at the 3 biggest names in Defense Industry as we going into the earnings cycle. Archna & I hope you find this information and the entire series on the industry useful.

Since we started writing about the defense industry, there has been a lot of news flow putting a spotlight on Defense. The continuing war, the rising tension in Taiwan Straights and South China sea, and an active cyber war has brought a new interest in the industry and its prospects in the coming year. The replacement cycle for equipment sent to Ukraine, the new technology being inducted to prepare for the wars of tomorrow has begun and this is supported by the new purchase orders being announced in the past month.

The FY 2023 DoD Budget request of $773.0 billion is a $30.7 billion, or 4.1% increase, from the FY 2022 enacted amount. The Senate Armed Services Committee has voted to approve a record $858 billion in military spending for Fiscal Year 2023. The final discussion on the defense bill is in progress in the senate.

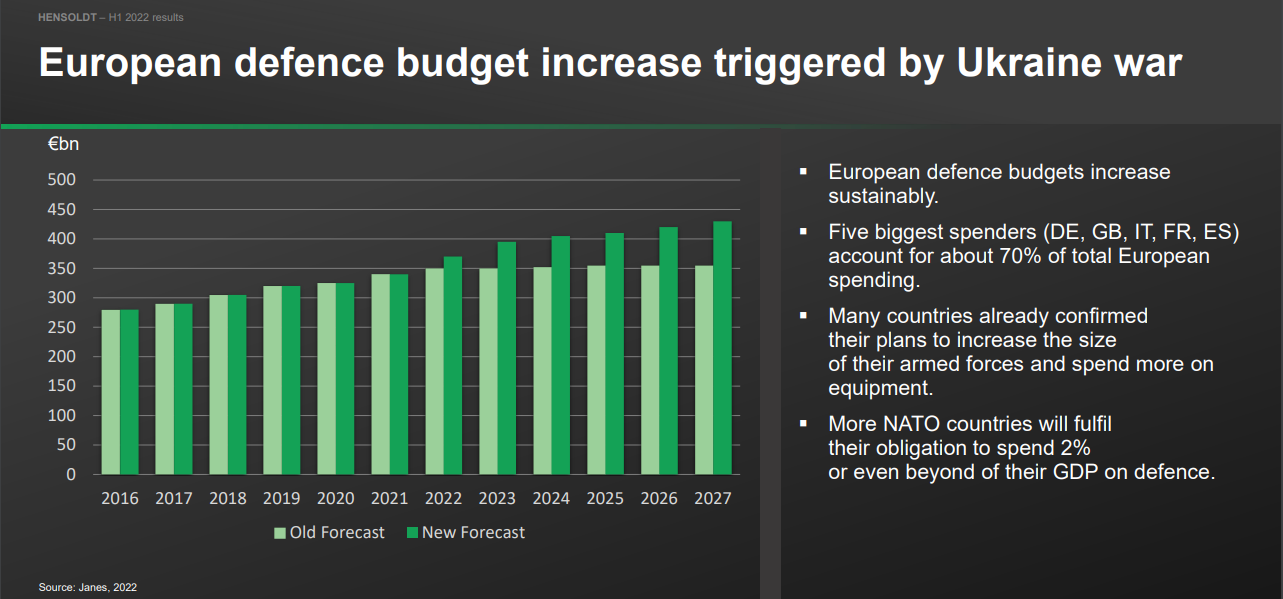

The situation in Europe is not very different. Every NATO member has increased their defense spending to some extent and many of them are working to get to the goal of 2% GDP into defense (still years away). Germany is looking to spend an additional $140b until 2030.

Sweden and Finland are joining the NATO and the countries bordering Russia are pushing NATO to increase presence in their countries to provide deterrence.

Finally, the performance of NATO equipment in comparison to Russian ones in the war, has given impetus to kick off orders to have these equipment since there is significant lead times.

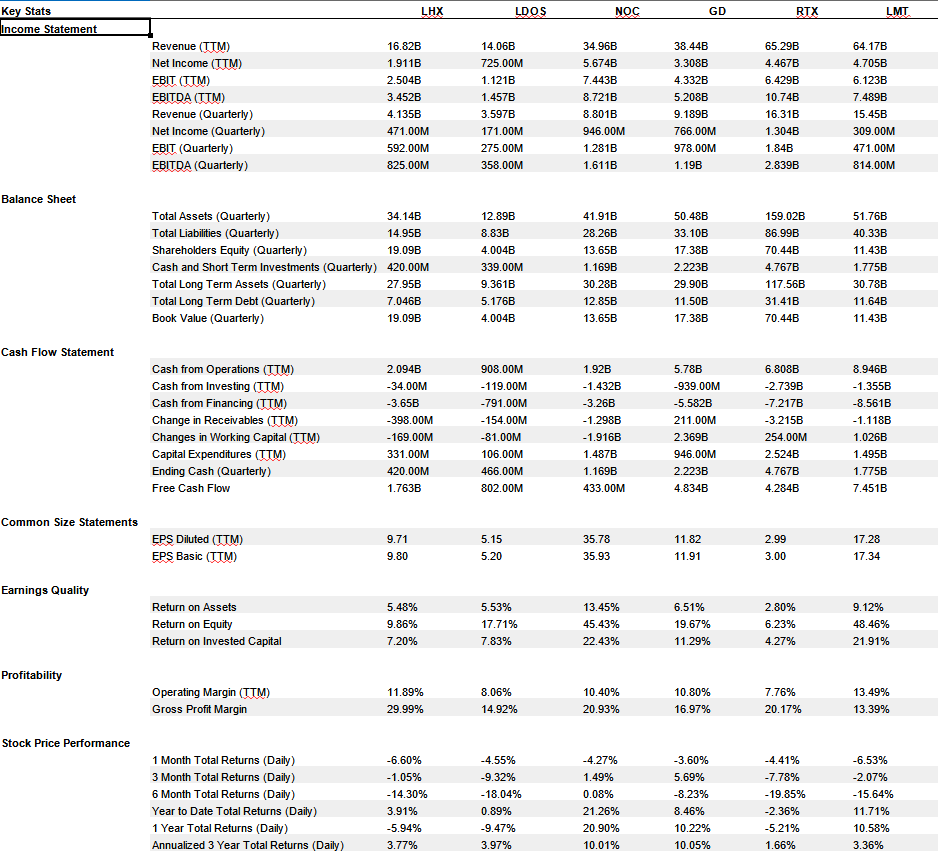

We have covered a dozen companies in the previous articles in the series. We are going to go in-depth into the largest companies in the industry: Lockheed Martin, Raytheon, General Dynamics, Northrup Grumman, L3Harris and Leidos. We will break up this article into 2 posts looking at 3 companies at a time. Here are some detailed Financial and Performance comparisons before we highlight some individual details:

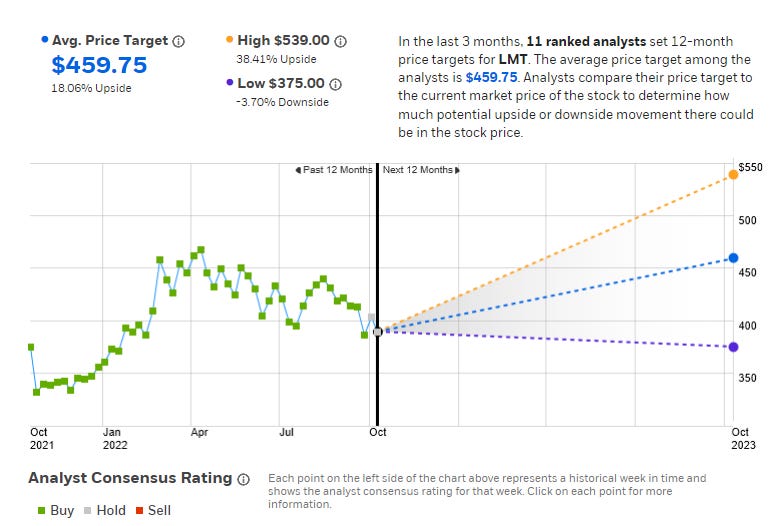

Lockheed Martin is the largest defense contractor globally and has dominated the Western market for high-end fighter aircraft since the F-35 program was awarded in 2001. Lockheed’s largest segment is aeronautics, which is dominated by the massive F-35 program. Lockheed’s remaining segments are rotary and mission systems, which is mainly the Sikorsky helicopter business; missiles and fire control, which creates missiles and missile defense systems; and space systems, which produces satellites and receives equity income from the United Launch Alliance joint venture.

In the last quarter, the main stumbling block was (1)parts and component shortages, (2)production costs increases in F35 program that necessitated pausing of work while the agreement to rework contract was being negotiated (3)Labor Shortages. The company cut its FY22 EPS guidance but kept the Cash flow guidance. The Pipeline is also much improved over previous years. LMT is expected to report EPS of $6.732 and Revenue of $16.69b.

Let’s go through charts for LMT:

The chart may look busy but it is very clear that we are approaching the AVWAP (the blue line) which is at 382. The 61.8% fib retracement drawn from Oct 2021 lows to ATH (all-time high) is at 384.

Below this 382 level, the next support is the 233-week MA, 78.6% fib retracement, 2018 highs, and trendline converging levels all near that 360-365 level.

These are the levels of support I am watching to see if buyers step in. Unless we get above the 440 level, the trend is down.

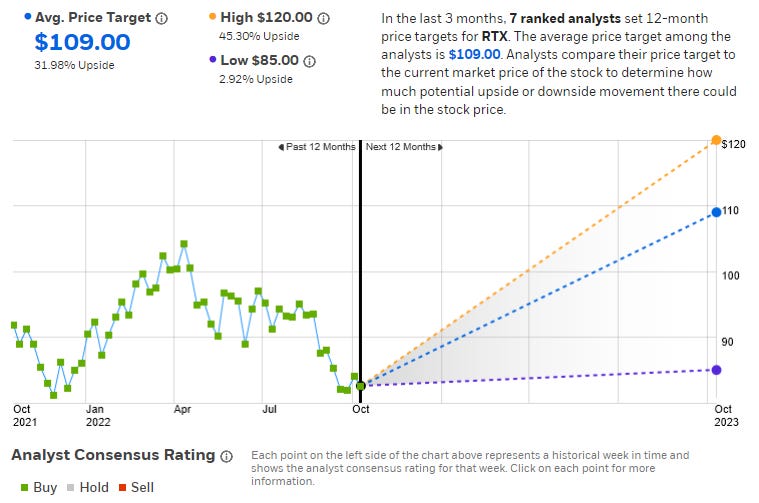

Raytheon Technologies is a diversified aerospace and defense industrial company formed from the merger of United Technologies and Raytheon, with roughly equal exposure as a supplier to commercial aerospace manufactures and to the defense market as a prime and subprime contractor. The company operates in four segments: Pratt & Whitney, an engine manufacturer; Collins Aerospace, a diversified aerospace supplier; Intelligence, Space and Airborne Systems, a mix between a sensors business and a government IT contractor; and Integrated Defense and Missile Systems, a defense prime contractor focusing on missiles and missile defense hardware. Raytheon could benefit from strength in commercial and defense business. The resumption of 787 deliveries is a positive catalyst for the company. There could be continuing shortfall in engine deliveries due to parts and labor shortages.

For Q3 Raytheon is expected to earn an EPS of $1.14 on a Revenue of $17.23b

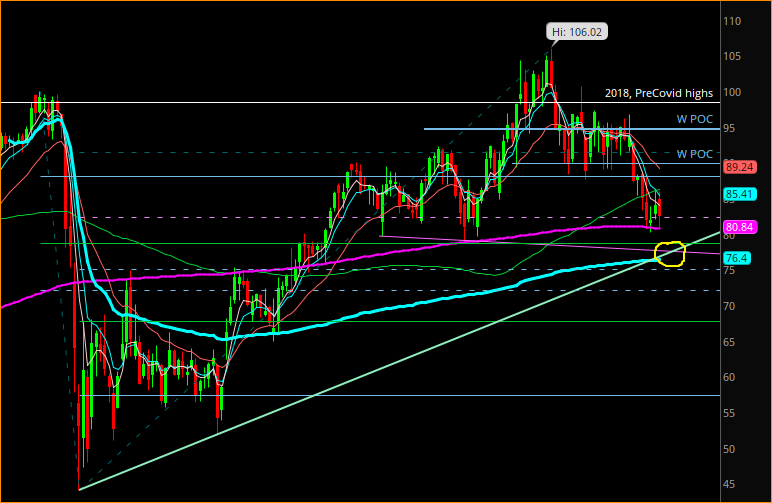

RTX is already at the 233-week MA support. Here too the confluence of support is close. The uptrend line, the AVWAP support, 50% fib retracement from COVID lows to ATM (all-time highs), broadening formation trendline, all are near the 75-77 area.

This 75 level is very important. Breaking below the trendline and remaining below this trendline opens to even lower prices. Then we are looking at a 61.8% retracement level of 67.6. After this level we have the 78.6% fib retracement at 57.36 This 57.36 will also be the measured move of the Head & shoulders pattern.

So, ideally, RTX gets to the confluence of the 75-77 level, finds buyers, and regains the uptrend line.

On the upside, above 90, RTX gets back in uptrend. But kept failing at the 94-96 levels from May 2022 to Aug 2022. So unless it has a weekly close above 96, RTX is a play from 75 to 90 price area.

General Dynamics is a defense contractor and business jet manufacturer. The firm’s segments include Aerospace, Combat Systems, Marine, and Technologies. The company’s aerospace segment creates Gulfstream business jets. Combat system produces land-based combat vehicles, such as the M1 Abrams tank. The marine subsegment creates nuclear-powered submarines, among other things. The technologies segment contains two main units, an IT business that primarily serves the government market and a mission systems business that focuses on products that provide command, control, computers, intelligence, surveillance, and reconnaissance capabilities to the military.

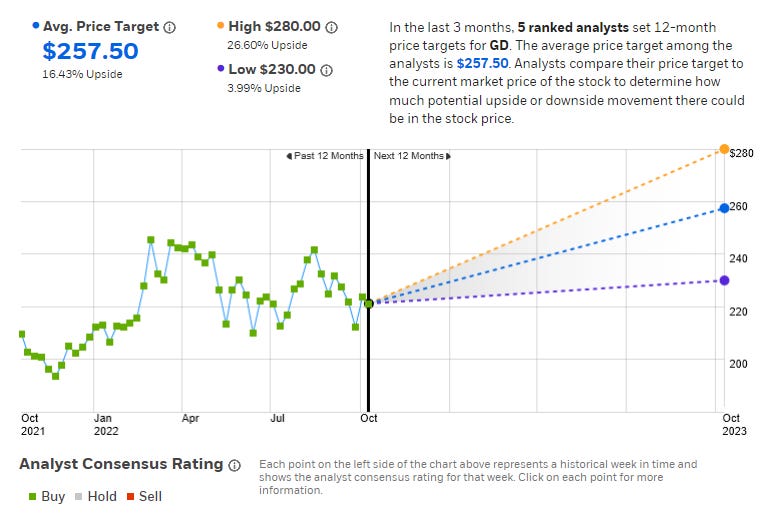

For Q3 GD is expected to earn an EPS of $3.156 on a Revenue of $9.931b

GD unlike LMT and RTX has held up well during these volatile markets. Hence the trendline is steeper in this case. And we broke it this past week for the second time.

You can say that this is the general that is now finally finding sellers. 100-week MA is nicely around the round number 200 price. The next level of support is 196.51 (this is the 38.2% fib retracement from COVID lows to ATH and also a 100% fib extension. Below 196.51 then we have the 233-week MA, AVWAP, 50% fib from COVID lows in that yellow box drawn.

When GD comes to the 200-round number if it finds buyers and if current market conditions have improved then it may easily hold this level. But any weekly close below 200, then the 180-185 level is the next demand zone

As always, these are purely educational and informative and not meant to be a recommendation of any of the companies mentioned. You should always do your own due diligence before investing and talk to a Registered Investment Advisor.

IF you like these articles, please subscribe and follow @monetivewealth and @archna2011 on twitter.